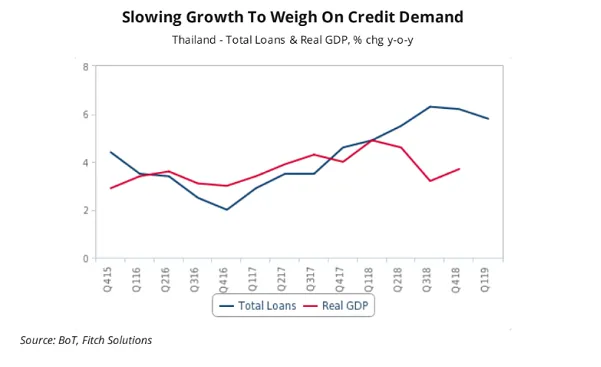

Thailand banks' loan growth to slow to 4.5% by end-2019 as mortgages take hit

The LTV limit of 80% on home loans will cool demand for mortgages.

The expansion of Thailand banks' loan books is expected to slow to 4.5% in end-2019 from 6.2% in the previous year following punitive measures to curb the growth of mortgages, according to a report from Fitch Solutions. Loan growth already shrunk to 5.8% in March from 6.2% in December 2018.

In an effort to curb risks, the central bank implemented successive rounds of macro-prudential measures including raising the loan-to-value (LTV) limit of 80% on home loans which kicked into efefct on April.

Also read: Thailand braces for fresh wave of bad loans as propery market cools

"These measures are likely to curtail credit demand for mortgages, which make up about 14% of all loans, over the remaining quarters of 2019. This negative effect is made more likely by a frontloading of housing transactions in Q119 before the onset of the new LTV limits," Fitch Solutions said in a report.

"This is corroborated by loan growth for the purchase of homes, which surged to 9.3% y-o-y in Q119, the highest figure since Q216."

The uncertainty surrounding the formation of the next government and escalaing trade tensions will also prompt less borrowing and stem credit demand.

Advertise

Advertise