Thailand

Thai banks say liquidity is sufficient

Thai banks say liquidity is sufficient

Thai banks are cool to Finance Minister Kittiratt Na-Ranong's advice to recapitalise as many of them have built up reserves aggressively in the past year.

KrungThai Bank eyes Bt14 B capital increase

KrungThai Bank hopes to raise at least Bt14 billion via a rights offering.

CIMB Thai woos retail clients with new deposit structure

CIMB Thai Bank is adjusting its deposit structure to expand the number of retail customers.

Thai finance minister urges banks' recapitalisation

Deputy Prime Minister and Finance Minister Kittiratt Na-Ranong encouraged Thai banks to recapitalise to cope with growing loan demand ahead of the activation of the Asean Economic Community in 2015.

Myanmar outlines monetary development plan

Myanmar has outlined a master plan for monetary development to be implemented with the assistance of the World Bank.

Thailand's KBank to provide consultancy to retail customers

Kasikornbank will get more involved in financial advisory banking to help retail customers.

Thai loan growth to continue in Q3

Banks and non-bank institutions will continue to experience loan growth in the third, to a June survey by the Bank of Thailand.

Are Thai banks complaining about higher funding costs?

Find out what analysts from Asian Development Bank has to say.

Krung Thai Bank pilots corporate cash card

KTB will help companies manage their cash flow and reduce the risk of their payees holding cash through its new corporate cash card.

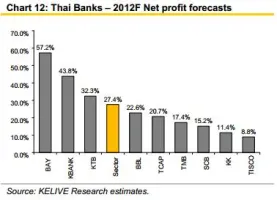

Thai banks' net profit to rise 27% this year

So which banks in Thailand will have the highest net profit growth in 2012?

SCB, Kbank tops among Thai banks in Q2 results

Siam Commercial Bank and Kasikornbank led Thailand's banks in net profits during the second-quarter.

SCB's quarterly earnings up 24%

Siam Commercial Bank's quarterly net profit increased 24 percent to Bt10.07 billion from Bt8.13 billion in the same period last year.

TMB Bank's net profit up 6% YoY

TMB Bank posted a 2Q12 profit of Bt1.26 billion, up by 6% YoY and 22% QoQ.

14 Vietnam banks make 62% of bad bank debts

Vietnam's 14 biggest banks accounted for as much as 62% bad debts of the whole banking system, based on yet another research report.

Thailand's Kasikornbank to open rep office in Myanmar

Kasikornbank has received a license to open a representative office in Myanmar.

Kasikornbank's earnings buoyed by loans, NIM

Kasikornbank reported a 4.22 percvxvcent in its consolidated second-quarter net profit of Bt9.4 billion.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership