Vietnam

Vietnam’s Techcombank sees net profits slide 17.1% in Q1

Vietnam’s Techcombank sees net profits slide 17.1% in Q1

Net interest income fell, but net fee income rose.

VPBank’s stake sale to SMBC to uplift its capital, balance growth plan

But “aggressive” growth plan, real estate sector woes will weigh on asset quality.

Vietnam conducts training on central bank digital currency

The course aims to upskill SBV and relevant agencies in Vietnam.

Citi completes sale of Vietnam retail banking, credit card units to UOB

This includes the turnover of approximately 575 related staff.

Techcombank reports profit before tax of $1.09b in 2022

Net interest income grew 13.5% during the year.

HDBank to issue $500m in convertible bonds to international investors

Proceeds will be used for the bank’s medium and long term capital.

Techcombank teams up with Adobe to deliver personalized banking solutions

The bank will use Adobe’s cloud platform to analyze customers’ browsing behavior.

Tien Phong Securities wins big in ABF Corporate and Investment Banking Awards

It was given the prestigious Corporate Client Initiative of the Year award.

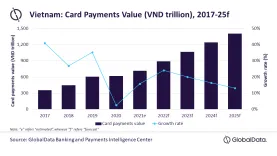

Vietnam’s card payments market to hit $37.6b in 2022

The government’s cashless payments push is helping the market.

Techcombank Aspire aims to empower customers, making banking seamless and easy

The bank won two trophies at the ABF Retail Banking Awards.

Sacombank crowned top Bank of the Year award in Wholesale Banking Awards

It was hailed as Vietnam Domestic Technology & Operations Bank of the Year by Asian Banking and Finance.

HDBank’s plan to buy unnamed “weak bank” to weaken loss buffers: Moody’s

Little is known about the target bank and what incentives Vietnamese authorities offer.

Techcombank reports 22.3% surge in before tax profits in H1

Total operating income reached $900m for the first half of the year.

UOB to facilitate US$2.4b pipeline of investments in Vietnam

This is expected to create 13,000 jobs in the country.

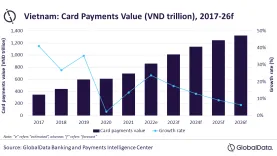

Chart of the Week: Vietnam’s card payments market to grow 24.1% in 2022

Strong anti-COVID measures allowed the market to reduce the pandemic’s impact.

Citi Vietnam appoints new country officer

Ramachandran A.S. will oversee Citi’s operations and serve as main regulatory representative.

UOB injects $88m in fresh capital for Vietnam charter

The capital injection was approved by the State Bank of Vietnam.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership