Vietnam

Vietnamese banks continue to grow consumer lending arms

Vietnamese banks continue to grow consumer lending arms

Techcombank is allowing borrowers to loan up to 10 times their monthly income.

Vietnamese banks' 2018 pre-tax profit surges 40% as bad debt crackdown pays off

Lenders were able to resolve $6.5b in soured loans.

Vietnamese banks' capital shortfalls triggers bond issuance frenzy

BIDV has approved the issuance of 400,000 bonds to raise $170.5m.

Vietnamese banks cash in on $44b consumer finance market

The pivot to retail has boosted NIMs, loan growth and operational efficiency.

E-wallet war heats up in Vietnam as banks join fray

Four more banks received clearance to operate e-wallet businesses.

Vietnamese banks slash service fees in economic boost

BIDV cut nine service fees whilst Military Bank reduced 16.

Vietnamese banks' war against bad debt pays off

Lower credit costs lifted average operating profit/risk weighted assets from 1.6% in 2017 to 2.2% in H1 2018.

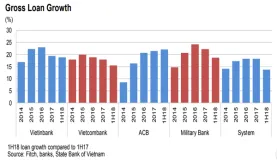

Chart of the Week: Vietnamese banks rapid loan growth moderates in H1

Retail and manufacturing loans drove H1 gains.

Vietnamese banks continue shedding bad debt in June

Non-performing loan ratio has fallen to 6.7%.

IFC seeks buyer for Vietnamese bank stake

This goes against the trend of greater investments in Vietnamese banks.

Capital crunch clouds Vietnamese banks' stellar half-year profit results

Lenders have been turning to IPOs and bond issuances to plug the gap.

Vietnamese banks step up bad loan disposal via auction

Agribank is planning to hold 12 auctions in September alone.

Can Vietnamese banks plug their massive capital shortage ahead of Basel II?

The banking system could face a $20b capital shortfall by 2020.

Vietnam intensifies crackdown against bad debt

Bad loan ratio fell from 2.46% in December 2016 to 2.09% in June.

Vietnam cracks down on Chinese mobile wallets

Banks are not officially connected to WeChat, making it illegal in the country.

Here's why foreign bank ownership cap is a boon for Vietnamese fintech

Investors may tie up with fintechs instead of banks.

Vietnam steps up efforts to boost weakened banking sector

The government aims to have up to five banks listed on foreign bourses.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership