Markets

Singapore banks' NIMs to degrade after US Fed surprise rate cut

Singapore banks' NIMs to degrade after US Fed surprise rate cut

DBS and UOB guided declines of 5-7bps.

Malaysia's latest OPR cut needed to cushion COVID blow

The central bank slashed OPR to 2.5% amidst the virus’ global and domestic impacts.

Solvency improvements threaten Vietnamese banks' strong 2019 performance

The State Bank of Vietnam is expected to allow Basel II banks to grow loans faster.

Philippine central bank to relax rules on ASF, COVID-hit banks

BSP may stagger booking allowance of credit losses and waive penalties.

Japan banks' profits, asset quality further battered by COVID-19 outbreak

Lower interest rates and higher credit costs spell more trouble.

Coronavirus outbreak pushes back funds for China's state finance firms

But they will continue to get government support given their involvement in public infrastructure.

Central bank's push for economic support a blow to Chinese banks

The PBOC has depended on banks for debt reprieve to virus-hit firms.

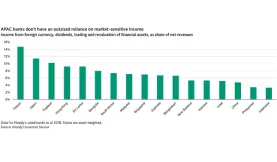

Chart of the Week: APAC banks not reliant on market-sensitive income

Further drops in prices of financial assets are likely if the COVID-19 outbreak persists.

COVID-19 pushes Thai asset manager to the top

Bangkok Commercial Asset Management’s shares ballooned by 74% this year.

Indonesia's central bank adopts Refinitiv Auctions for domestic NDFs

Refinitiv Auctions facilitated over $1.23t in 2019.

Asian bankers ready for nCov deal droughts

Several auctions and potential Chinese IPOs are being delayed or re-assessed.

Chinese financial firms face heightened risk from coronavirus outbreak

A significant loosening in the monetary policy will exert additional pressure on bank capital.

Malaysian banks boast ample capital despite higher buffer requirement

The central bank has currently set the countercyclical buffer at 0%.

Singapore's central bank urges boosting of finance measures vs nCov

Internal controls and demands for financial services should be managed.

Coronavirus will have little impact on Malaysian banks: analyst

Overnight policy rate cut and the 2019 nCov dented the sector.

China banks' NPL ratio could rise up above 6% if nCov outbreak persists

This could lead to shaving off 378 basis points from the sector’s capital adequacy ratio.

Singapore's central bank implements Payment Services Act

Acts on money changing and payment systems have been repealed.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership