1 in 2 Hongkongers hold ‘favorable’ views of virtual-only banks: study

45% have neobank accounts, and another 30% looks to sign-up over the next 3 months.

Over 1 in 2 or 52% of Hong Kong individuals considered themselves knowledgeable about and hold favourable regard towards virtual banks, a recent study showed.

The study, conducted by The Virtual Banking Education Taskforce (VBE Taskforce), an initiative set up by the Hong Kong Association of Banks (HKAB), found that of 1,000 individual respondents at least 70% consider virtual banks as innovative and convenient.

Despite this, the number of respondents holding a virtual bank account is much smaller, at 45% of the respondents.

This number is slated to increase, however, as 30% of respondents expressed an intention to sign up for a virtual bank account in the next three months.

ALSO READ: Greenwashing in banking: real concern or overblown issue?

High deposit interest rates, rewards for opening an account and convenience to use were also key factors that motivated individual respondents to open virtual bank accounts, the VBE Taskforce reported.

Small and medium enterprises (SMEs) have a better impression of virtual banks, with 90% considering virtual banks as convenient and efficient, citing the banks’ technology-enabled advanced services.

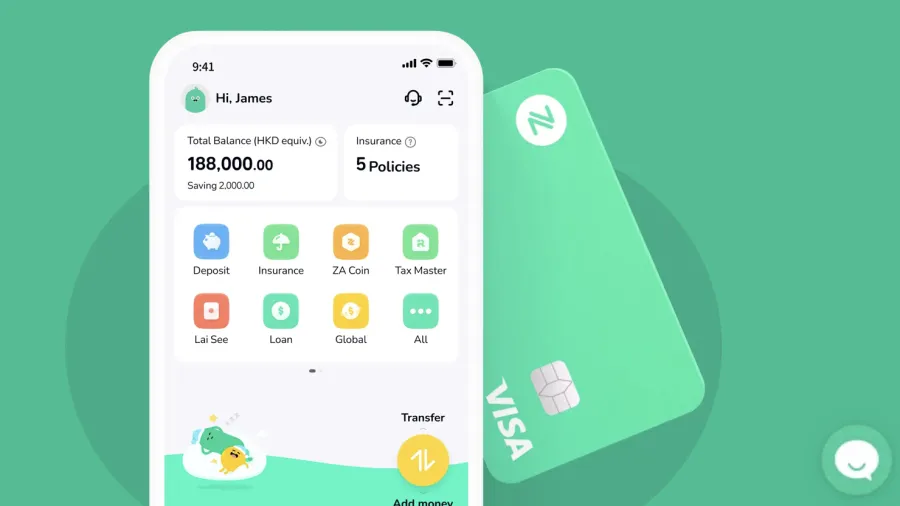

ZA Bank, one of Hong Kong’s virtual banks, welcomed the findings of the survey.

“ZA Bank is pleased to see the public’s increased acceptance of virtual banking, which is the result of the industry’s concerted effort over the past four years,” said Calvin Ng, alternative chief executive of ZA Bank.

“As a tech-driven bank, we have always exerted our strong tech DNA to provide a convenient and seamless banking experience while leveraging cutting-edge technologies to enhance the security level of our services to protect users’ assets,” Ng added.

Advertise

Advertise