75% of Singapore SMEs mull ditching banks for payment needs

1 in 2 of SMEs in Singapore complained of lengthy processing and settlement times.

About 3 in 4 (75%) of small and medium enterprises (SMEs) in Singapore said that they are ready to switch away from traditional banks for their payment needs, reveals a study by payments and financial platform Airwallex and consultancy firm Edgar, Dunn, & Company.

Almost the same share (72%) of Singaporean SMEs would be prepared to pay more to work with a software provider that has all-encompassing financial capabilities, the study claims.

Meanwhile, 1 in 2 (52%) of SMEs in Singapore agreed complained of the lengthy processing and settlement times when receiving payments abroad.

ALSO READ: How can financial institutions build customer loyalty in the modern era?

Globally, over 8 in 10 small businesses are looking to switch away from traditional banks for the payment needs, reveals a study by payments and financial platform Airwallex and consultancy firm Edgar, Dunn, & Company.

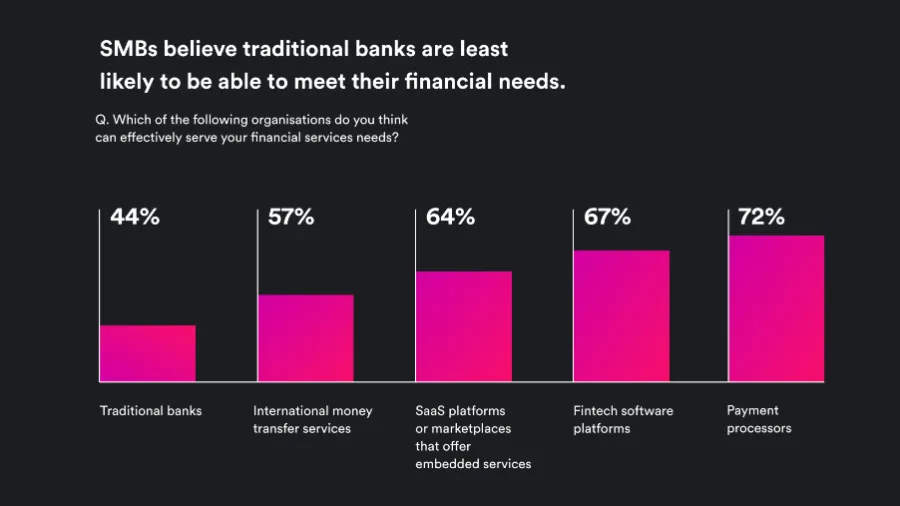

Only 1 in 3 (33%) of SMEs have confidence in traditional banks, most are skeptical about the prospect of a traditional bank meeting their financial services needs. Conversely, almost double (62%) think SaaS platforms or marketplaces that offer embedded financial services can effectively serve their needs.

The study surveyed 1,000 SMEs across Singapore, the US, the UK, China, and Australia.

Advertise

Advertise