Hong Kong’s livi bank records HK$17m operating income

Its loan balance has surpassed HK$1.3b as of end 2022.

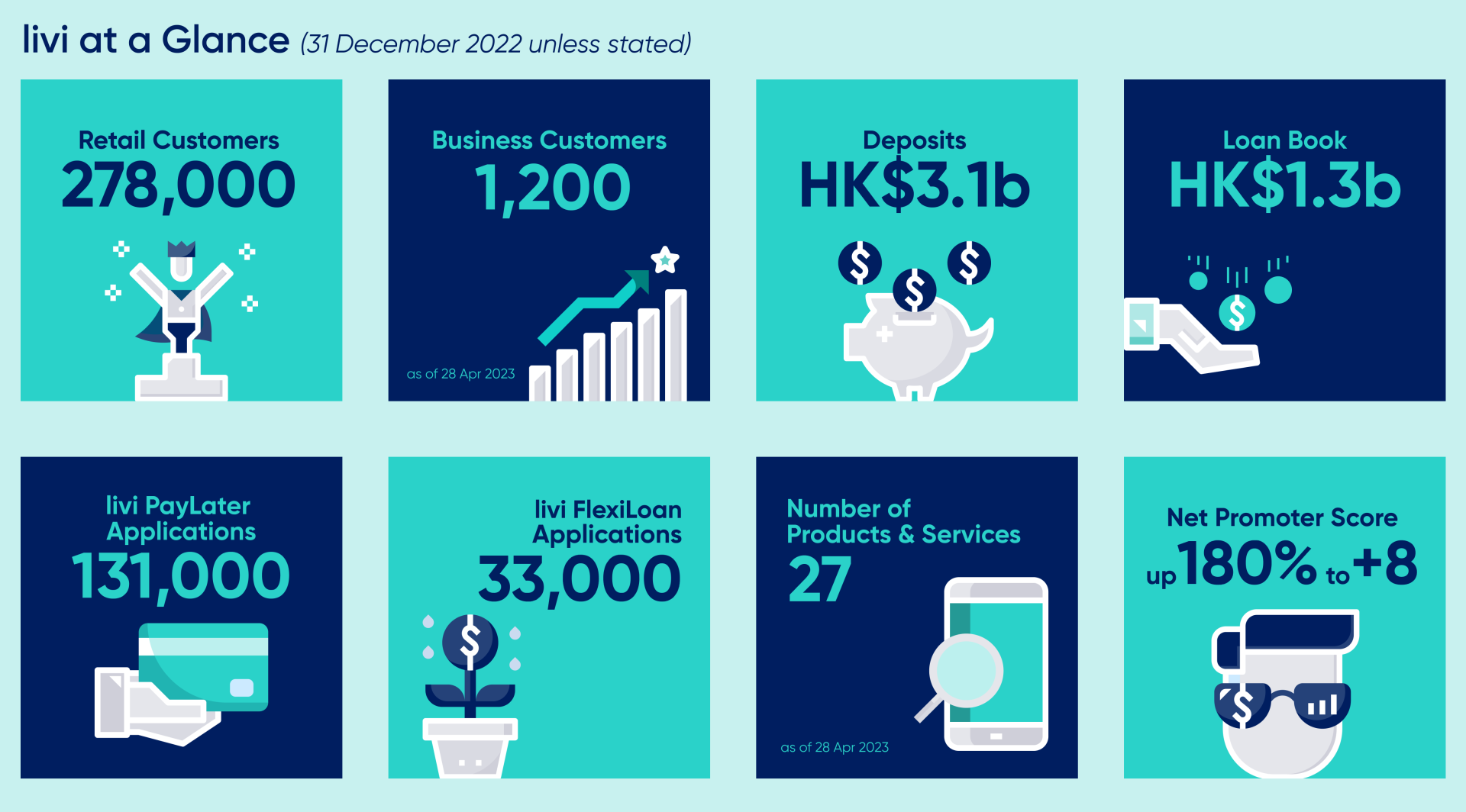

Hong Kong’s livi bank has recorded a positive operating income of HK$17m in 2022, which the bank attributed to its growing portfolio of loan products.

Its loan products, primarily the livi FlexiLoan, achieved a total loan balance over HK$1.3b by end-2022, according to livi bank’s 2022 annual report published on 28 April.

Deposit balance is at HK$3b. The loan-to-deposit ratio increases 14 times during 2022, which livi bank said is on a positive growth trajectory.

The bank said it recorded a loss of HK$715m for 2022 as it “remains in its investment and development phase.”

ALSO READ: HK’s livi bank launches QR payment option

David Sun, CEO of livi bank, said that the neobank is increasing emphasis in their “innovative revenue generating offerings.”

“To facilitate this, we are focused on making breakthroughs in three key segments – Retail banking, SME business banking and GBA financial offerings,” Sun said.

For 2023, livi bank is focusing on rolling out new SME banking offerings that will help the small companies achieve entrepreneurial growth via technology.

“Meanwhile, the exciting GBA market holds the promise of many opportunities ahead,” Sun said.

Advertise

Advertise