ZA Bank rolls out tax loan, offers cash rewards

Even unsuccessful loan applicants can receive a reward.

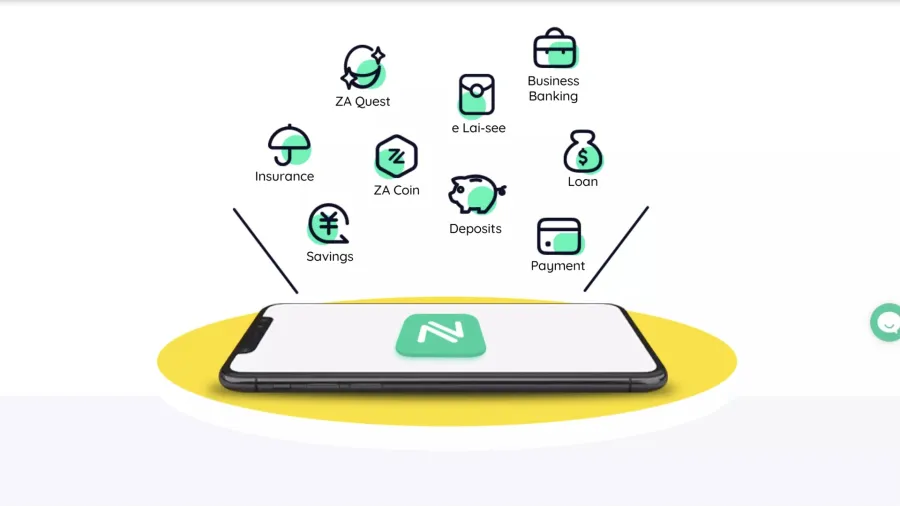

ZA Bank has rolled out a tax loan, offering up to a 60 month-tenor as well as cash rewards.

Until 31 January, ZA Bank users who apply for a tax season loan with the promo code “TAXLOAN”, and who successfully apply for a tax loan of HK$200,000 or above with a 24-month tenor or longer, will get HK$2,800 in cash rewards after a 7-day cooling-off period.

Tax loan customers who choose to make ZA Bank their payroll account can earn up to HK$100 per month, or a maximum of HK$1,200 in total, for 12 consecutive months.

ALSO READ: Hong Kong’s ZA Bank to roll out US stock trading services

ZA Bank promises a speedy approval process for the tax loan, with existing users getting a result in as fast as 30 seconds, and new users possibly as fast as 90 seconds.

For unsuccessful loan applicants, users can still receive a reward of HK$188, so long as they make the application before 31 January 2024 and maintain a valid and active ZA Bank account.

Advertise

Advertise