ZA Bank unveils payroll service with limited-time coupon

With the coupon, users can earn HK$1,775 in interest for a 90-day period.

ZA Bank has launched its new payroll service Salary+.

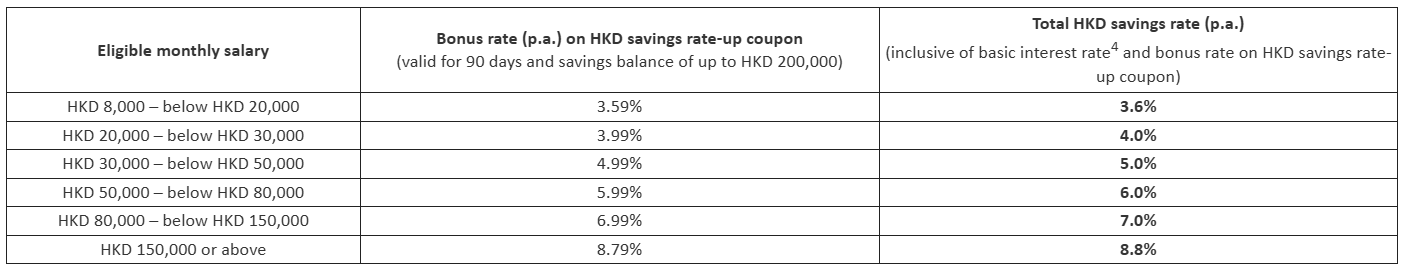

Users who receive their monthly salary via ZA Bank can enjoy a welcome offer of up to 8.8% per annum HKD savings rate.

Until 31 October, new payroll users who receive their first eligible salary with an amount of HK$8,000 or above via their ZA Bank account will receive one 3.59% per annum HKD savings rate-up coupon.

With the coupon, users can enjoy a combined 3.6% per annum rate for a maximum savings balance of HK$200,000. The coupon, valid for 90 days, will enable users to earn an interest of up to HK$1,775.

To qualify for the coupon, users must have received their first salary through ZA Bank within the first 90 days of successful registration, with the registration done through the designation campaign page, and their employer notified of the change of payroll account.

Users who receive a designated amount of monthly salary via ZA Bank for 3 consecutive months–including the month of their first payroll–will get a bonus reward.

Prior to Salary+, ZA Bank has rolled out a plethora of new services earlier in 2024. Recently, the Hong Kong-based virtual bank rolled a stock rebate program and dedicated Web3 services for stablecoin issuers.

Advertise

Advertise