News

New rules, price caps to push more mergers amongst Indonesia’s P2P lenders

New rules, price caps to push more mergers amongst Indonesia’s P2P lenders

The regulations will raise compliance costs, but price caps will make it hard to offset them.

Japan to break free from negative rate policy after wage hike: analyst

The negative rate environment is likely to end in April 2024.

Public Bank net profits up 8.7% in 2023; 10 sen interim dividend proposed

Total dividend is 19 sen per share for 2023, to be paid out on 22 March.

Indian commercial banks’ bad loans declined by 21.1% in 2023: analyst

Net non-performing assets dropped to a record low in Q3 FY2024.

Expected gov’t support to prop up the Industrial Bank of Korea’s solvency: analyst

Exposure to the property sector remains small and does not pose material risk.

Maybank Singapore gave out up to S$1,250 to junior employees

The one-time payment was given out in February.

DBS, OCBC, and UOB post combined net interest income of $8.3b in 4Q23

4Q23 marks the 5th consecutive quarter that the combined NII of the big three was above $8b.

Hong Kong’s mortgage demand rose 36.8% in January

Loans for brand new and resale residential properties registered double-digit increases.

RHB Bank net profit rise in 2023; net credit costs to rise in 2024

Net interest margin is expected to be “flattish” in 2024 at 1.9%.

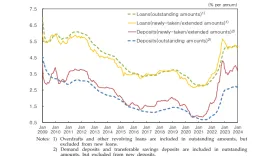

South Korea’s interest rates for new deposits, loans fall in January

Average interest rate for new loans taken by large firms dropped 12 basis points.

Japan banks’ domestic assets at $9.4t in January

Banks hold an additional US$1.6t of assets in their overseas branches.

JCB offers 10% cashback to Skyliner ticket

Members with a JCB card issued outside of Japan can avail of the cashback.

South Koreans’ card spending up 32% to $19.22b in 2023: report

The number of Koreans who traveled overseas tripled in 2023.

Model risk management vital for banking innovation

Ensuring effective decision-making and addressing new challenges like climate risk through robust model risk management.

Nature's decline threatens $10 trillion global GDP by 2050

There is a critical impact of biodiversity loss on the economy and the opportunities in sustainable investing.

Digido has served 1 million customers

Over 3 in 4 of the loans disbursed in 2023 were from repeat customers.

Weekly Global News Wrap: BBVA sets up finance unit for clean tech; Wells Fargo sued for ‘fake accounts’ scandal

Top regulator calls for EU banks to improve risk management.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership