News

Citi Hong Kong makes two senior appointments in Institutional Client Group

Citi Hong Kong makes two senior appointments in Institutional Client Group

The new appointments will be effective immediately.

MAS to explore digital assets use cases with Project Guardian

The first pilot sees DBS, JP Morgan, and Marketnode explore lending on a public blockchain.

Public Bank net profits down 8.6% in Q1 as one-off tax bites

The operating environment remains challenging, the bank’s founder said.

South Korea financial system face short-term crisis risk as inflation ramps up: poll

One in four experts warned of possible shocks.

Bank Raya offers instant bailout funds for faster small loan disbursements

Borrowers can access up to US$1,700 in loans.

Maybank adopts cautious outlook amidst geopolitical tensions, volatility

The Malaysia lender saw its Q1 profits fall compared to the same period last year.

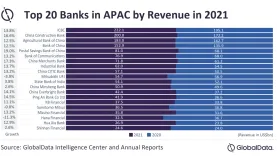

Asia’s Top 20 banks by revenue bounce back in 2021

But the recovery may not be sustained in 2022 as constraints pile up.

MAS slaps S$330m add'l capital requirement at OCBC after phishing fiasco

The review found deficiencies in the bank’s risk mitigation and incident management.

EastWest Bank to appoint new CEO, President

New CEO is current strategy consultant for the bank’s parent company Filinvest.

Over 17 million Koreans use online financial services daily: central bank

Two in three Korean respondents use mobile financial services.

Bank of Singapore appoints global head of investments

Robert Reid has 30 years of legal, consulting, and financial services experience.

OCBC invests S$25m to reduce carbon footprint in operations

The bank plans to retrofit its buildings with solar panels.

E-payments poised to replace credit cards in China, Indonesia: Experian

Buy now, pay later has been eagerly embraced by Indonesians.

Weekly Global News Wrap: US to bar Russian bond payments through US banks; England warns profit hit should banks fail to take climate action

And Barclays identifies material weakness in the internal control process.

Hong Kong fintech krip launches deals, offers platform for credit card users

Users can access over 6,000 deals from 3,000 merchants.

Bank of Singapore appoints wealth planning head for Greater China

The bank has also hired a senior wealth planner, to be based in Singapore.

Grab unveils new financial brand GrabFin

It also rolled out its investment product, Earn+, with a projected yield of up to 2.5% per annum.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership