News

MAS and Bank Indonesia extends $10b bilateral financial agreement

MAS and Bank Indonesia extends $10b bilateral financial agreement

The two extended the agreement until 4 November 2022.

Singapore to invest S$180m for AI research

Heng kicked off the SFF 2021 and announced two new national AI programmes.

Eight Singapore banks to participate in new eGIRO launch

The digitisation initiative aims to cut down the old GIRO process from weeks to minutes.

HKSTP unveils R&D environment for testing fintech innovations

Banks and tech firms can use Fintech Virtual Lab to build and test innovations.

DBS’ net profits jump 31% to $1.7b in Q3

The non-performing loans rate remained unchanged at 1.5% during the quarter.

OCBC allows real-time digital purchase of gold, silver

Over $1m and 3,698oz of precious metals have been purchased through the app.

HSBC invests $2b to be a ‘digital first’ bank

Part of that investment means partnering with more fintechs to create digital banking products.

OCBC’s net profits up 19% to S$1.22b in Q3

Net trade income plunged 67%, slightly offset by stronger net fees and commissions.

UOB Q3 profit leaps 57% to S$1.05b

Net profit also saw a rise of 4% QoQ.

Westpac capital position to remain strong following A$3.5b buyback

Westpac is one of Australia’s four major lenders.

Singapore’s SMBs adapt as more consumers seek contactless payments

Nearly four in five Singaporeans expect to use contactless payments, the highest in the world.

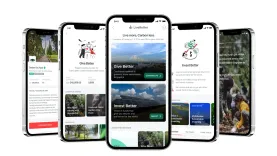

DBS rolls out one-stop sustainability-focused platform

The bank will also launch an autonomous carbon calculator service under LiveBetter.

Citi names global head of D10X under institutional clients group

The D10X focuses on the development of new solutions for Citi's institutional clients.

FSI Conference 2021 features discourse on digital transformation in the banking and finance industry and an exclusive presentation from Bain & Company

This two-hour digital conference will happen on 1 December 2021.

Hitachi Vantara spearheads virtual roundtable in modern DataOps

Hitachi’s Chief Solution Architect Seng Joo, Lim will open the first speaking session.

Standard Chartered partners with Kredivo to offer BNPL in Indonesia

Assets of fintech players in the country grew by more than IDR1t or by over $70m.

HSBC Singapore extends S$6m green loan to Durapower Group

Durapower will use the loan for its lithium-ion energy storage solutions.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership