Chart of the Week: China gradually opens up $16.5t card market to foreign players

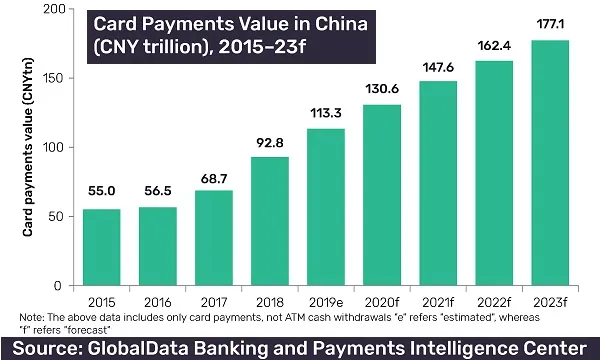

Card payments value is expected to grow 11% CAGR to $25.9t by 2023.

The Chinese government is gradually opening up its card payments market for international operators, according to data and analytics firm GlobalData, with the latest entrant being Mastercard.

The $16.5t card payments market is much bigger than that of developed markets such as the US ($7.2t) and the UK ($1.1t).

Just this month, Mastercard received approval from the People’s Bank of China (PBOC) to set up a domestic bankcard clearing business in China, as a result of recent US-China trade deal.

In November 2018, American Express became the first foreign card network to gain approval to establish a network to clear card payments in the country.

Visa is also reportedly planning to set up a wholly foreign-owned company in China and is seeking a clearing license, according to GlobalData.

“The Chinese payment card market has traditionally been a closed market with high entry barriers. The licensing for foreign operators will bring competitiveness to the market, which is predominantly occupied by state-owned domestic card scheme UnionPay,” noted Ravi Sharma, banking and payments lead analyst at GlobalData.

Before, although foreign card schemes are already in the market, they are mainly issued in collaboration with UnionPay under the co-badging agreement. This meant that all local transactions are processed by UnionPay whilst foreign schemes are only able to manage overseas transactions.

But with the new licensing, foreign schemes will also be able process transactions locally via their own infrastructure.

However, China’s cards market remains less attractive than it was 20 years ago due to the rise of e-wallets, with mobile payments solutions such as Alipay and Tencent dominating the market.

Despite this, China remains a potential market for overseas card players.overall card payments value is expected to expand at a compound annual growth rate (CAGR) of 11.8% between 2019 and 2023 to reach $25.9t, according to a report from GlobalData’s payment cards analytics unit.

Advertise

Advertise