News

Vietnamese banks' 2018 pre-tax profit surges 40% as bad debt crackdown pays off

Vietnamese banks' 2018 pre-tax profit surges 40% as bad debt crackdown pays off

Lenders were able to resolve $6.5b in soured loans.

Tech firms set to raise stake in Korea's internet-only banks

IT firms will soon be allowed to hold as much as 34% stake.

Malaysian bank mergers unlikely to take place in 2019

Lenders still have to work on improving ROEs first.

Chinese commercial banks bad loan ratio hits 10-year high in 2018

Total non-performing loans hit $296.52b (CNY2t) in December.

Philippine bank loans grow 16.8% to $155.85b in November

This represents a slower growth rate compared to October.

Hong Kong banks' 2019 loan growth cut to 2% as trade and mortgage loans take hit

Lending to Mainland firms has been trending downwards to 6.1% in September 2018.

Philippine banks scramble after Korean shipbuilder default

The country’s five biggest banks have a $412m loan exposure.

Malaysian banks hike salaries by up to 12% for 20,000 employees

Banks also have to grant 0% interest for the first $24,414 in staff housing loan.

Are Singapore banks bracing for another O&G nightmare amidst Coastal Oil troubles?

The indebted crude oil supplier owes the three Singapore banks a combined US$172.1m.

Weekly Global News Wrap Up: Slow start to fintech revolution as only 4 new UK banking licenses issued in 2018; Deutsche cuts bonus pool by about 10%

And an estimated $1t in UK bank assets left Britain following Brexit.

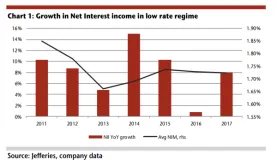

Chart of the Week: Singapore bank revenues may rise 9% in 2019

Loans and balance sheet leverage will be the growth drivers.

India's Bandhan Bank gears for $11.7b merger

The deal will create one of India’s largest rural and semi-urban lending platforms.

Hong Kong banks loan growth rebounds 5.2% in November

Business sentiment recovered mildly as corporates ramped up borrowing.

Singapore banks' earnings turnaround hit by steep funding costs

NIMs have inched up by 2-12 bp since 2015 even as the 3M SIBOR soared 58bp.

It's the most wonderful time of the year!

We're taking the time off!

Deutsche Bank sees exodus of 30% of workforce in Singapore and Hong Kong

This translates to almost 50 investment bankers leaving in the past six months.

Weekly Global News Wrap Up: Can global bank stocks bounce back in 2019?; Saxo Bank to buy Dutch online lender for $480m

And here's how Brexit is affecting Credit Suisse's wealth management strategy.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership