News

Big Philippine banks' profits rose 9.3% to $3.07b in 2018

Big Philippine banks' profits rose 9.3% to $3.07b in 2018

Interest earnings buoyed yearly profits despite higher borrowing costs.

Hong Kong mortgage loans down 20.7% to $23.5b in December

Weakening property demand weighed on loan growth.

South Korea's property curbs cool January household loans

The growth was its lowest since November 2017.

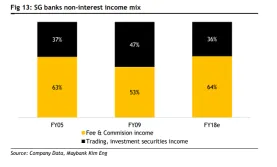

Singapore banks shun risky trading over stable fees and commissions

The share of trading and investment securities income shrunk to 36% in 2018 from 47% in 2009.

Hong Kong banker bonuses drop by a fifth as stock markets fall

Some local brokers had to make do with a lai see.

Malaysian bank loan growth drops further to 5.6% in December

Working capital, construction, home and auto loans weakened.

Weekly Global News Wrap Up: US consumer loan demand takes hit in Q4; Canada housing slump prompts calls for looser mortgage rules

And HSBC is said to be cutting over 50 investment banking jobs.

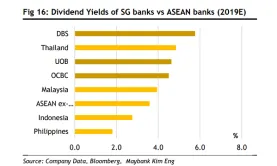

Chart of the Week: Singapore banks' dividend yields eclipse ASEAN peers at 5.1% in 2019

Such levels are higher than banks in Indonesia and the Philippines.

Vietnam hammers hard on bad loans as banks clear $6.42b in soured assets in 2018

This brings the bad loan ratio to 1.89% in 2018 from 1.99% in 2017.

3 in 5 Singaporeans believe fintechs are as trustworthy as banks: survey

Around 13% even believe that fintechs deserve more trust than old-guard lenders.

Philippine bank accounts up 6.8% to 57.1 million in 2017

The number of unbanked local government units also dipped to 554 from 582.

China urges banks to temper lending in January

Banks typically front-load loans early in the year.

Cambodia and Thailand ink deal on QR code scheme

It aims to boost local currency usage of both the riel and baht.

Foreign players can now buy into Myanmar's domestic banks

They can hold up to 35% stake in local lenders.

India lifts curbs on three public sector banks as recovery looms

They have successfully met capital and bad loan requirements.

Singapore bank loans grow 3% in December

Business lending grew to 4.1% even as loans to consumers softened.

Indonesia gears to set up mega-lender to oversee 40% of banking assets

The four state banks will be put under the holding company, PT Danareska.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership