News

Taiwanese banks expanding to Cambodia, Vietnam, and the Philippines

Taiwanese banks expanding to Cambodia, Vietnam, and the Philippines

Exposure to these markets grew 20% per year over 2015-2016.

How does Korea's rising household debt levels affect banks' financial stability?

There are no immediate concerns, says Moody's.

Here's why you must attend the 2017 ABF Retail Banking Forum Manila

It will be held on February 15 at the Makati Shangri-La.

Which Malaysian bank will benefit the most from slowing household loan growth?

Total outstanding household loans grew at a slower rate of 5% in 2016.

Taiwanese banks' shift away from China likely to continue: Fitch

The banks' mainland China exposure fell to 6.2% by end-2016.

Number of ATM cash withdrawals worldwide up 10% in 2015

Chinese ATM usage accelerated to 23%.

Indonesia tax amnesty programme to have limited impact on Singapore banks

Total overseas asset declaration stood at S$108b.

Malaysian banks' deposits growth slowed to 2% in December

Business deposits contracted 2.3%.

Chinese bankers brace for "brutal bonus season": Reuters

Dwindling business on local stock markets is to blame.

Japanese banks' loan growth expected to slow in 2017

Blame it on the rising costs of foreign-currency funding.

Indian banks' loan growth predicted to be below 10% in FY17

It may even slow from the 8.8% recorded in FY16, says Fitch.

Malaysian banks' loan growth up 5.3% in 2016

Household and non-household loans also expanded at a similar rate of 5.3%.

Asian Banking and Finance Wholesale Banking Awards 2017 now open for nominations

Entries are accepted until April 14.

Weekly Global News Wrap Up: EU banks could take up to 5 years to Brexit; Deutsche Bank fined $630m; Citi launches lending website

And find out what the biggest bankers are planning post-Brexit.

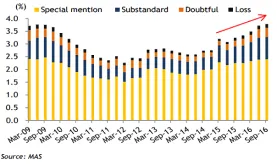

Chart of the Week: Singapore banks' classified exposure level at its worst since 2009

The banks' credit quality is still worsening.

Indian banks' asset quality indicators close to their weakest levels

Recovery will be slow over the next few years.

Hong Kong banks still well capitalised despite poor profit outlook

Total capital ratio came in at 19.4% in September 2016.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership