News

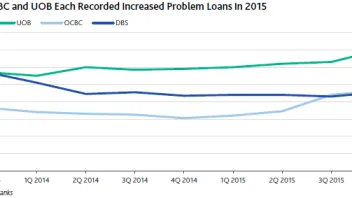

These charts summarise Singapore banks' worrisome O&G exposures

These charts summarise Singapore banks' worrisome O&G exposures

The banks will likely suffer from deteriorating asset quality.

Indonesia's reserve requirement cut from 7.5% to 6.5%

It will free up $2.5 billion of banks' mandatory deposit reserves.

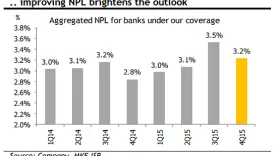

Bank Mandiri needs higher NPL buffer, warns analysts

NPLs rose despite strong 12% growth.

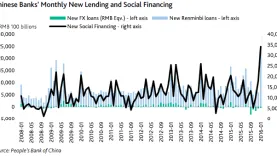

New RMB loans hit a record RMB2.51 trillion in January 2016

The pace of credit growth exceeds economic growth, analysts warn.

Maybank Indonesia's net profit surged 61% in 2015

Net profit after tax and minority interest reached Rp1.14 trillion.

Bank of the Philippine Islands' earnings down 16% to USD92m in 4Q15

Blame it on the trading income drop.

This is a make-or-break year for OCBC’s management: analysts

It’s poised to see more asset quality deterioration.

DBS’ net profit jumps by 20% to $1b in 2015

On back of higher non-interest income.

Thai banks' gross NPL down 6.2% to THB335b at the end of 4Q15

NPL ratio of every bank fell from 3Q15, except for KBANK and TMB.

OCBC’s net profit inches up 2% to $3.91b in FY15

Thanks to associates’ increased contributions.

How will the proposed liquidity tightening affect Vietnamese banks?

The share of short-term funding that banks can use for loans will be decreased.

UOB’s FY15 net profits dip 1.2% to $3.21b

Due to a higher tax provisions write-back in FY14.

How badly can RHB’s oil and gas exposure hurt its profitability?

It would slip into the red if 40% of its O&G book turned non-performing.

HSBC to invest further in the Pearl River Delta

But it will remain headquartered in the UK.

Asian Banking and Finance Wholesale Banking Awards now open for nominations

Entries are accepted until April 22.

It’s official: DBS is no longer Southeast Asia’s largest bank

Indonesia’s BCA snatched the crown.

A massive banking crisis is brewing in Singapore, says Swiss billionaire Zulauf

The three biggest banks are losing capital.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership