News

What are BDO's targets for its most recent acquisition?

What are BDO's targets for its most recent acquisition?

The goal is to expand One Network Bank’s branches by 15 this year.

Barclays' private wealth business could generate net profits of SGD43m for winning bidder

Provided that there are not bad debts.

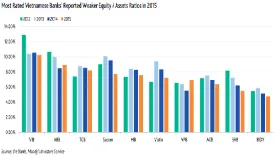

Vietnamese banks suffer from weaker equity-to-asset ratios

It decreased to 7.3% as at end-2015.

3 Malaysian banks with the largest increases in common equity Tier 1 ratios revealed

Two of them completed large rights issues in 2015.

Korean banks likely to step up the issuance of bank capital securities: Fitch

Higher capital requirements will be phased-in by 2019.

How bad will the rest of 2016 be for Chinese banks?

Fitch expects subdued earnings growth to persist.

DBS, OCBC go head-to-head in race for Barclays' private wealth units

The deal is valued at $300m.

2 reasons why you must attend the ABF Retail Banking Forum in Kuala Lumpur on April 6 at the Shangri-La

Artificial intelligence in ATMs is on the rise.

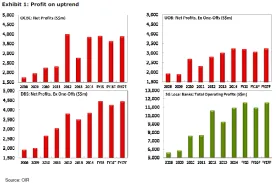

These graphs show the worst may finally be over for Singapore banks

Profits are on an uptrend.

Philippine National Bank's trading gains drop 55%

But this is offset by a 25% increase in net service fees.

Bank Danamon reveals six factors behind its dire situation

Net profit declined 8% in 2015.

Will consolidation in the Indian banking sector be a boon or a bane?

The long-term benefits far outweigh short-term challenges.

Indonesian banks to face persistent headwinds in 2016: Fitch

Second-tier lenders are in a more vulnerable position.

Are the Philippine banks ready for the financial consumer protection regulations?

Banks have varying degrees of readiness.

Macro headwinds slowly taking their toll on Singapore banks' loan growth

But the banks' credit profiles are still intact, says Fitch.

Bank Central Asia's non-performing loans could peak above 1%

It includes its IDR509b loan to Trikomsel.

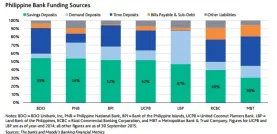

Most Philippine banks well-positioned to comply with new liquidity requirements: Moody's

Philippine banks are 85% deposit-funded on average, and rely little on wholesale funds.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership