News

Singapore banks must brace for flat underlying earnings growth in 2013

Mild uptick in credit costs offsets single-digit revenue growth, says Barclays.

Financial firms less dependent on banking credit

Continue to turn to shadow banking for funds.

CDB to finance more infrastructure projects in China

China's largest infrastructure project lender to fund more urbanization-related projects.

Krung Thai Bank eyes 15% fee income growth for 2013

It will benefit from the government’s THB2t infrastructure spending over the next seven years.

Philippine banks to raise more capital to meet Basel 3 guidelines

Maybank says capital instruments issued in 2011 will be qualified until 2015 but older issuances will be ineligible.

Sumitomo Mitsui’s market value rises by 5.1%

Recent stock market rally also benefits other Japanese megabanks.

Union Bank of the Philippines surprises with Php7.6b profits in 2012

It's 8.5% higher than analyst's estimates.

Hong Kong banks' trade finance to grow 20% in 2013

It's also expected to be more China-biased.

Goldman Sachs cuts its stake in ICBC for the fifth time since 2009

GS sold around 1.34b H-shares of ICBC.

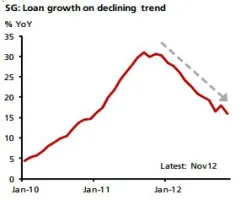

Singapore's loan growth feared to be on a declining trend

Overall loan growth is expected to moderate to 8% this year.

State Bank of India to open second Chinese branch

Will be located in Tianjin, the largest coastal city in northern China.

Hana Financial to delist KEB after buy out

Will follow its taking over 100% of Korea Exchange Bank.

Probes reveal banks' manipulation in Singapore’s offshore FX market

Evidence surfaced that traders colluded to manipulate rates in Singapore's offshore foreign exchange market.

Maybank eyes Muslim market in southern Philippines

Maybank will expand its financial services and investing in the Mindanao region of the Philippines.

Hong Kong banks threatened by intensifying competition from foreign banks

Aggressive Chinese banks increased their presence in Hong Kong from 9% to 15%.

Metrobank's loan growth forecast to increase 15% in 2013

Transaction fee income is an impetus for earnings expansion.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership