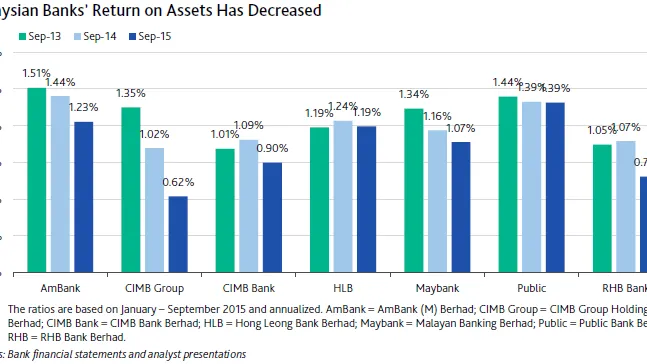

3 graphs that show the alarming deterioration of Malaysian banks' profitability

Decreasing RoA, rising NPLs, and pressured NIMs haunt banks.

When RHB Bank released its nine-month 2015 earnings results, it showed deteriorating profitability. Moody's Investors Service says the results were in line with other Malaysian banks’ decreased profitability owing to rising credit costs and shrinking net interest margins (NIM), a credit negative that may lead to capital pressures. "We expect Malaysian banks’ profitability deterioration to continue into 2016 as the operating environment will remain challenging."

Moody's says the banks' return on assets has fallen to a three-year low. Nonperforming loans and credit costs are also rising, and elevated funding costs has caused banks to have pressured NIMs over the past 12 months.

Here are three graphs that show these trends, as reported by Moody's.

Advertise

Advertise