Singapore banks brace for weaker non-interest income

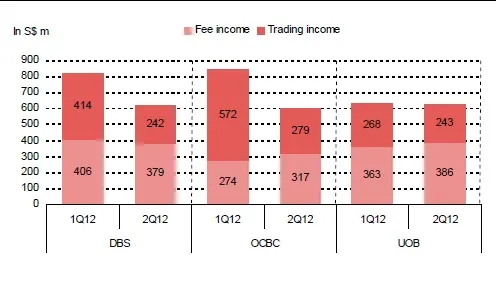

Trading-related income fell 39% qoq to S$764m in 2QFY12, says CIMB.

Here's more from CIMB:

Weak non-interest income outlook

Trading-related income fell 39% qoq to S$764m in 2QFY12, impacted by market uncertainties and weak capital markets performance. On a brighter note, sector fee income grew 4% qoq to S$1.1bn. OCBC and UOB saw stronger investment, trade and loan-related fees.

So far, the banks have been depending on fee income to make up for profitability that was missing in NII. We have concerns on potential slippages ahead as loan growth slows and China’s growth decelerates, while weak intra-Asia trade figures suggest lower demand for offshore trade financing. The challenge for the sector is topline growth.

Advertise

Advertise