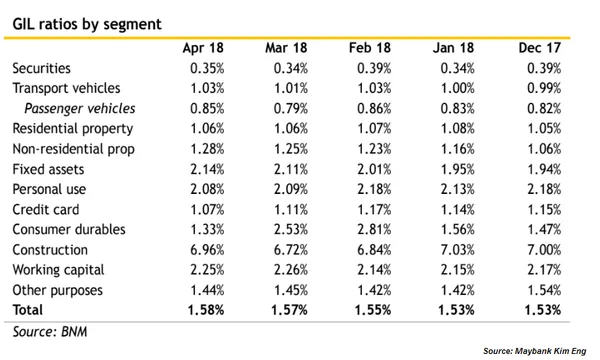

Chart of the Week: Bad loans in Malaysia inch up to 1.58% in April

The construction segment had the highest gross impaired loans at 6.96%.

The gross impaired loans (GIL) ratio at Malaysia's banking industry inched up from 1.57% in March to 1.58% in April, according to Maybank Kim Eng,

Also read: Malaysian bank earnings may slow to 9.7% amidst new leadership

Higher bad loans from the commercial property and auto portfolios led the marginal increase although GIL ratios remained largely stable across most other asset classes. The construction segment had the highest GIL ratio at 6.96%, which is almost triple the overall system ratio.

However, the banking system's capital positions remain stable even as CET1 ratio, core capital ratio and risk-weighted capital ratio inched down from 12.9%, 13.8% and 17.2% respectively in April versus 13.2%,14.0% and 17.5% the previous month.

Lending is also picking up pace after loans grew from 4.4% YoY in March to 4.8% YoY in April.

Also read: New financial reporting standards will not materially impact Malaysian bank assets: Moody's

A sustained demand for household loans in light of the prevailing tax-free (GST-SST) period was noticeable as lending increased from 2.9% YoY in March to 3.6% YoY in April. Non-residential property lending growth normalised to from 1.6% in March to 2% YoY in April, whilst personal lending growth picked up pace from 5.4% YoY to 6% YoY. over the same period.

On the non-HH front, working capital loan growth picked up pace to 1.3% YoY, after having stagnated at 0.3% YoY in March. On a sectoral basis, manufacturing loan growth rebounded, whilst stronger growth was reported for wholesale/retail and construction sectors.

Advertise

Advertise