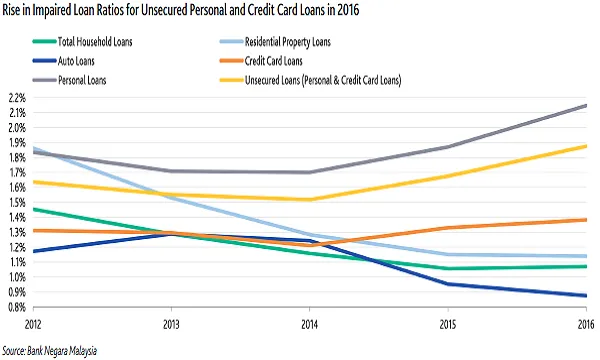

Chart of the Week: Check out Malaysian banks' impaired loan ratio for unsecured loans

It stood at 1.9% at end-2016.

According to Moody's, while asset quality for residential mortgages (55% of total household loans) and auto vehicle loans (19%) stayed unchanged from a year ago, the impaired loan ratio for unsecured loans — including personal and credit card loans — rose in 2016, indicating an increase in loan delinquencies and defaults among unsecured household borrowers.

Here's more from Moody's:

At end-2016, the impaired loan ratio for unsecured loans was 1.9%, much higher than the ratios for other household loans, reflecting the higher risk nature of the unsecured household loans.

However, slow growth in unsecured personal loans and credit cards has reduced the banks’ exposure to these risky loans to 12% of total household loans at end-2016 from a high of 15% at end-2011, which is positive for the banks’ asset quality.

The continued deceleration of household loan growth will help stabilize the high household leverage situation in Malaysia, which is among the highest in Asia. We expect that household debt to GDP for 2016 will moderate from the 89% recorded at end-2015.

Similar to household loans, the asset quality of the banks’ corporate loan portfolios remained stable at 2.3% at end-2016.

Impaired loan ratios have either improved or remained flat year-on-year across most industry sectors, except for commodity-linked mining and manufacturing sectors — which collectively made up 8% of total system loans at end-2016 — with impaired loan ratios at end-2016 higher than a year ago.

Advertise

Advertise