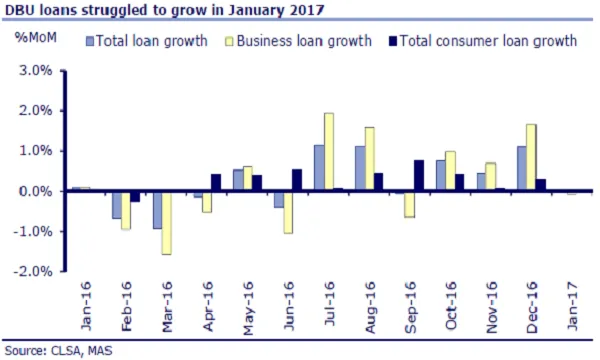

Chart of the Week: Singapore banks' domestic loans struggled to grow in January

DBU corporate demand was weak during the Chinese New Year.

According to CLSA, system loans (DBU+ACU) grew 0.2% MoM (Dec: 0.5%), driven by a 0.5% expansion in ACU (predominantly financial institutions and general commerce, partially offset by lower manufacturing, agriculture/mining and infrastructure.

Here's more from CLSA:

Domestic business unit (DBU, proxy for domestic lending) loans were flat MoM, although we note that the period around Chinese New Year is typically seasonally weak for DBU corporate demand.

By sector, an expansion in infrastructure and FI loans were completely offset by declines in GC, agriculture and manufacturing.

Consumer growth was anaemic; lower credit card and share financing balances fully offset growth in mortgages.

Advertise

Advertise