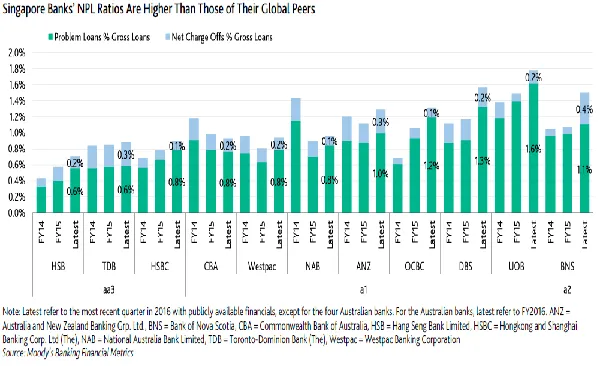

Chart of the Week: Singapore banks' NPL ratios higher than their global peers'

OCBC has the highest proportion of overseas NPLs.

According to Moody's Investors Service, driven by the Singapore banks' diverse geographic mix, particularly in higher risk markets in other parts of Southeast Asia and Greater China, the banks’ NPL ratios are above those of their global peers, which tend to have limited operations outside their home markets.

"Among the three banks, OCBC has the highest proportion of NPLs due to its overseas (outside Singapore) exposures of 79% at end-September 2016, with the bulk of the NPL increases in 2016 belonging to oil services companies domiciled in Indonesia and Malaysia. In contrast, UOB has the highest proportion of NPLs due to its Singapore portfolio, driven by oil services borrowers, its sizable exposure to small- and medium-sized enterprises (SMEs), mortgage NPLs related to a fraud incident in 2014, as well as legacy NPLs in the shipping industry," adds Moody's.

Advertise

Advertise