Chart of the Week: Thai banks' Q2 stressed loans hits 2.95%

NPL improvements were seen in the manufacturing and commerce sectors.

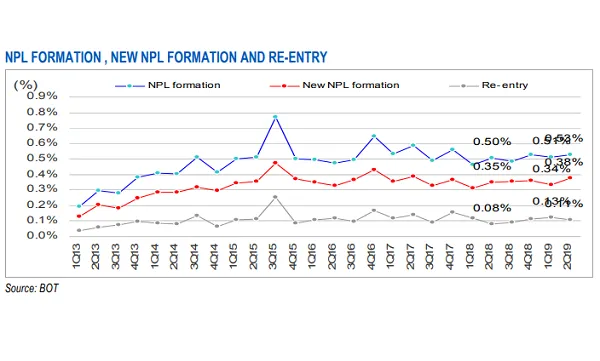

Banks in Thailand kept their asset quality at check as the system's non-performing loans (NPL) held steady at 2.95% in Q2 from 2.94% in the previous quarter following improvements in the manufacturing and commerce sectors, according to UOB Kay Hian.

Also read: Can Thai banks keep their bad loan woes at bay?

NPL re-entry also eased to 0.11% of total loans in Q2 from 0.13% in Q1 amidst improvements in key segments except for real estate and construction whose re-entry rose to 0.19% of total loans from 0.08% in Q1.

On the other hand, NPLs rose for service, mortgage and auto loans with the last two segments witnessing NPL growth for three consecutive quarters.

Similarly, reported total NPLs formation edged slightly higher to 0.53% of total loans in Q2 (2Q18: 0.50%, 1Q19: 0.51%) amidst higher new NPL formation, which rose to 0.38% of total loans from 0.34% in Q1. Key areas of deterioration came from manufacturing, service and personal consumption.

"Higher NPL formation and rising SML could pose a near-term risk to an NPL uptick in upcoming quarters. Any increase in NPL, in our view, could be moderate and manageable, partially offset by continued write-off and restructuring," analyst Thananchai Jittanoon said in a report.

Advertise

Advertise