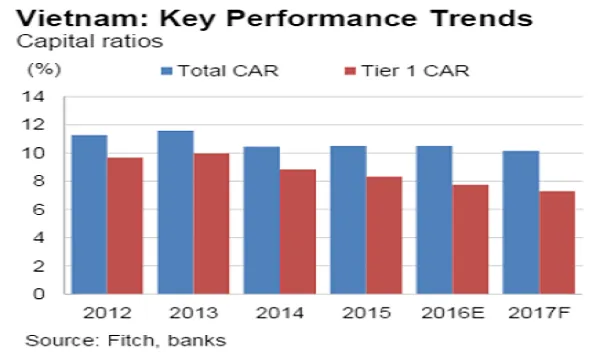

Chart of the Week: Vietnam banks' capital buffers to remain under pressure

The banks' capital adequacy ratios are arely above the minimum requirement of 9%.

Capital adequacy ratios for commercial banks and state-owned banks in the first half of 2016 were 12.1% and 9.3%, respectively. Fitch Ratings says this is barely above the minimum regulatory requirement of 9%.

Here's more from Fitch:

Fitch believes the underlying capitalisation is likely to be even weaker in light of industry-wide under-reporting of NPLs. We expect capital buffers to remain under pressure as Basel II capital-adequacy standardsa are being phased in at a time when loan growth has picked up - in addition to their weak internal capital generation.

Ten banks have been designated to move to Basel II, with full adoption expected by end-2018. We expect banks' CARs to be pushed lower by the shift to a relatively more conservative regime.

Advertise

Advertise