Chinese banks warned against rising bad debt as measures subside

CBIRC also warned against emerging local real estate bubbles.

The China Banking and Insurance Regulatory Commission (CBIRC) has said banks should protect themselves against higher non-performing assets as the country withdraws some relief measures implemented during the pandemic, reports Reuters.

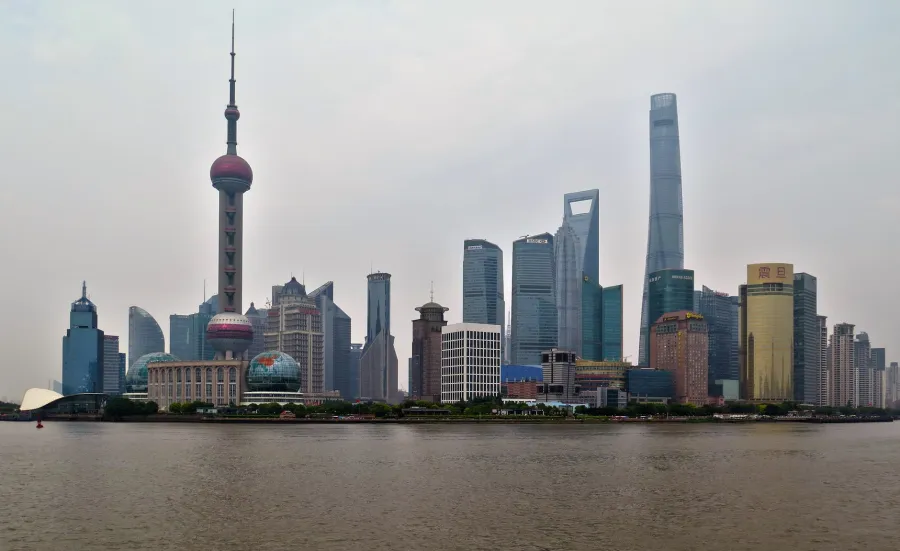

"The default rate for some large and medium-sized enterprises has risen, and the credit risks at banking institutions has intensified," CBIRC chairman Guo Shuqing told a financial forum in Shanghai via a video message, adding that an emerging trend of domestic real estate bubbles remained “serious."

Corporate bond defaults have risen sharply in China in recent years, reaching $14b in 2020, according to the Institute of International Finance. Chinese banks also extended a record $3t in new loans in 2020, data from the People's Bank of China showed.

Investors should also be aware of potential investment losses on financial derivative products, commodity-linked futures, and rising Ponzi schemes, Guo warned.

Here's more from Reuters.

Advertise

Advertise