Frances Gagua

Check out how APAC family offices moved their investments in Q2

Check out how APAC family offices moved their investments in Q2

There was “moderate” client interest in longer-dated US Treasuries and perpetual bonds.

PayPal is most popular digital payment option in Asia: study

In the BNPL space, Klarna, Atome, and Afterpay are the region’s most popular choices.

Bank of East Asia’s profits up 75.8% to HK$2.63b in H1

Higher interest rates pushed up profits, but non-interest income fell.

Security Bank launches human capital management platform

It will service its 7,000-strong workforce.

1 in 4 Hong Kong consumers eyes getting a loan with fintechs, neobanks

Although traditional banks remain the preferred choice, 1 in 5 are ready to jump ship to another provider.

Bank of Singapore names Credit Suisse banker as new global COO

Jacky Ang is also Credit Suisse’s SG branch manager and head of wealth management.

DBS unveils metaverse game tackling global food waste

Singapore players will be treated to extra rewards, redeemable through DBS PayLah!

Mizuho, Shinhan ink cooperation agreement to service start-ups

They will provide financial services to start-ups in accordance with start ups’ growth stage.

China’s financial sector may be hit by Zhongrong’s missed payments

The ongoing property sector downturn poses a larger risk for the trust industry.

China state-owned banks to post ‘sharp’ revenue decline: report

Banks are battling lower lending rates, ongoing property woes, and low interest margin.

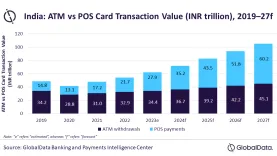

India’s card payments market to rise 28.6% to $337.1b in 2023

Consumers in India are increasingly embracing electronic payments, GlobalData said.

DLT, digital money rise as securities sector eye faster settlements

The move to T+1 has given birth to challenges in the securities ecosystem, said Citi.

Which countries charge the highest ATM withdrawal fees?

The Philippines is the most expensive place in Asia to withdraw cash via ATM.

Consolidation in the cards for Australia’s mutual lenders

Mutuals should scale back branch operations and invest in tech.

Gojek launch point rewards program with yuu, DBS

Users can earn up to 37 points for every $1 spent on Gojek rides.

DBS Hong Kong finalises HK$800m green loan with HSH

KPIs set include reduction in carbon intensity, increase in waste diversion rate, amongst others.

Bank of East Asia extends hours of Shenzhen Futian Port sub-branch

It is now open on Saturdays from 10 AM to 5PM.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership