Journey towards financial inclusion in Bangladesh

By Md. Touhidul Alam KhanBangladesh has established its position as a pioneering country to have made significant strides towards financial inclusion and its vision ‘Digital Bangladesh’. The country’s recent development in its financial sector, varied heritage in credit and microfinance, widespread adoption of digital finance and mobile financial services (MFS) are recognized at a global level. The government’s effort to consider financial services as drivers of shared prosperity and inclusive growth. Access to financial services and their usage have significantly positive impacts on the socioeconomic outcomes that are perceived by businesses and households. Moreover, this access and usage are considered as essential factors to poverty eradication.

On the other hand, financial exclusion being persistent has negatively affected inclusive growth, shared prosperity, social cohesion, financial stability, and income equality. Bangladesh’s development strategies suggest that national development be undermined without the availability of financial services in an expanded manner among the population. As the country has the aim to build an enlightened, happy, and prosperous Bangladesh where people will not suffer from corruption, hunger, illiteracy, inequality, and poverty, and they will have complete rights to their country, easy access to financial products/ services is a prerequisite to inclusive development.

Financial Inclusion-Where Bangladesh Stands

The rapid growth of Bangladesh’s economy is one of its powerful drivers to facilitate financial inclusion. With an annual GDP growth of more than 6% over the last decade, Bangladesh has seen a wider distribution of gains where agricultural modernization and migration have contributed to growth in a relatively even pattern along with persistent income inequality represented by the Gini Index or Coefficient which was marginally rising in the 2000s. New employment opportunities in the export industries like RMGs and foreign remittances from Bangladeshi immigrants and migrants have fostered development which has helped reduce the size of the population below the national and extreme poverty line, causing the proportion to decline from 49% (2000) to about 21% (2018).

In Bangladesh, occupational relationships keep changing which create demands for financial products that are new. According to the Labor Force Surveys (2006 - 2017), a remarkable increase has been noticed in the available employment opportunities in different sectors including the industrial sector (rising from 15% to 20%) and the service sector (from 37% to 39%) where the agricultural sector is an exception to see a decline from 48% to 40% of employment. The proportion of salaried manufacturing jobs has grown enough to provide higher and more stable earnings which bring employees an incentive to look for formal financial products/ services to manage their cash flows. Among 24 million paid adult employees in 2017, 57% received salaries in monthly installments, and 34% received daily payments. Of all paid laborers in the agricultural sector, 61% got paid on a daily basis. In addition, a large portion of this labor force is still self-employed, and they carry out work without payments. The size of this particular group keeps declining relative to paid labor, but their financial needs are evolving, particularly the self-employed individuals and small business owners. This population will surely increase the need for new financial services in the coming years.

In Bangladesh, behind financial inclusion are three major factors: (i) localities that are difficult to access: remotely located and sparsely populated hilly areas; char, haor, and similar other areas with tough terrain; and areas with underdeveloped infrastructure; (ii) impediments that are induced by demands: poor income, lack or unavailability of financial education and awareness, social segregation or exclusion along with other constraints that restrict economic opportunities; and (iii) bottlenecks that are led by the supply system: distantly positioned bank branches, inappropriate timings, time-consuming documentation, cumbersome requirements and prolonged procedures, inconvenient delivery methods, unsuitable products, unfriendly staff, etc. that exclude specific groups. There are other factors such as limited or no access to the ownership of land, limited financial capability, and collateral for the female population and persistent lack of formal identification.

Bangladesh has become a leader in MFIs across the globe alongside its private and state-owned commercial and specialized banks, non-bank financial institutions, and insurance companies. Banks can develop alternative banking and financial channels by including ATMs and multibank switches namely Q-Cash, Cash Link, and Omnibus. MFSs have presented a tangible opportunity to create an alternative banking channel to make the points of transaction more accessible and widely available. Banks have been trying to establish agent banking as a formidable alternative for remotely located consumers, particularly in rural areas where they can access different financial services. The networks of Agents can rapidly help to improve the breadth and scope of the entire financial system.

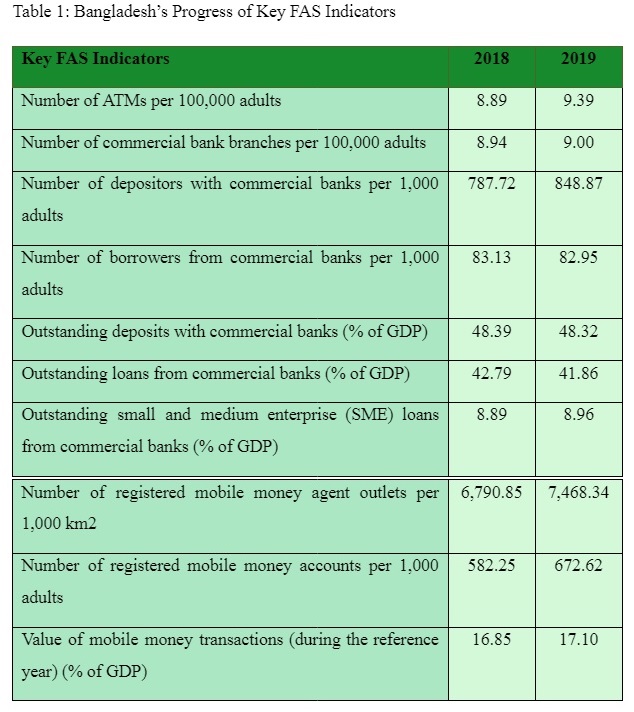

Although the key FAS indicators above were published by the IMF in 2020, they contain data from 2019. Bangladesh Bank, the central bank, collects relevant data regularly from all financial service providers of the country where the total number of ATM machines, Bank Branches, MFS Accounts, Deposit accounts (with Special A/C), Agent and School Banking accounts are included.

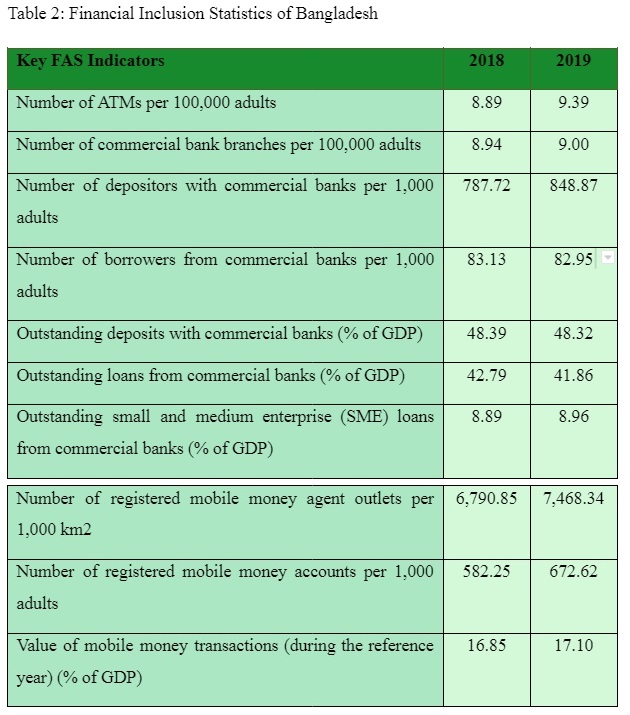

Table 2 shows the gradual progress in the number of Agent Banking Accounts, Deposit A/C (with Special A/C), and MFS Accounts from 2017 to 2020. Considering the existing scenario indicated by the above tables, an opinion can be formed that Bangladesh has made progress in both its delivery of financial services and strategy for financial inclusion during the years 2017 to 2020.

National Financial Inclusion Strategy (NFIS) - An Overview

A national financial inclusion strategy (NFIS) is a comprehensive public document formulated at the national level to systematically accelerate the level of financial inclusion in a given country. An NFIS is developed through a broad consultative process involving public and private sector stakeholders, engaged in the development of the financial sector. Typically, an NFIS will include an analysis of the current status and constraints on financial inclusion, a measurable financial inclusion goal, how the country proposes to reach this goal and by when, and how it would assess the progress and achievements of the NFIS. It can be defined as roadmaps of actions, agreed and defined at the national or sub-national level, which stakeholders follow to achieve financial inclusion objectives.

The Rationale for NFIS

Financial inclusion cannot be undertaken by a single institution from the public or private sector, not even a regulatory authority. All initiatives and efforts need to be taken with required collaboration, cohesion, and coordination by all stakeholders to ensure sustainable inclusion towards an inclusive goal of socio-economic development. The leadership and commitment need to come from the decision-making level that must also spearhead all these efforts. This particular lesson is the foremost one learned from the country’s journey to sustainable financial inclusion. Experiences obtained throughout the decades show that regulation, risk management, innovation, and technology need to be put in the right balance. As much essential innovation is; regulation is equally required to balance the outcome of the innovations. Otherwise, the outcomes will not be perceived completely. Similarly, risk management has to be appropriately handled to supplement the overall usage and adoption of technology.

Promotion of Inclusive Finance:

Bangladesh Bank should consider the contribution of green financing and CMSME to employment generation, food security, environmental conservation, poverty alleviation, and agriculture, and take them as the priority sectors where financial inclusion can take place.

FinTech and Digital Financial Services:

The clearing system for the payment systems in Bangladesh has been experiencing a serious transition from manual to fully automated since 2010. Commercial banks are now shifting from their manual payment methods to the automated solution through a core banking network, which indicates a gradual shift from paper money to ATM cards and various other methods.

Payment Systems during Covid-19 Pandemic:

To prevent the COVID-19 from spreading far and wide, the Government of Bangladesh (GoB) had to impose a lockdown and social distancing policy along with movement restriction all over the country for months when only some emergency services were available.

Despite these efforts, the negative impacts on the country’s socio-economic condition could not be averted. The countrywide lockdown and restrictions upon movement intruded the rapid spread of COVID-19 to some extent, but at the same time, it affected Bangladesh’s supply chain system badly as small enterprises and marginal people had to face a grief condition with their livelihoods. Since people had to stay at home, payment activities became challenging for them. Under these circumstances, an automated mode of payment that costs low was crucial to the restoration of payment and other financial activities. The central bank took a good number of initiatives to ensure quick access and usability of safe and secure digital payment methods for all.

The strength and stability of Bangladesh's economy comes from the rapid growth of deposit liabilities, loans, and other financial resources over the past decades. Despite the development of the country's financial structure starting in association with the public sector after its independence, the financial sector is being dominated by a whole new generation of private commercial banks. The lessons originating from the edge of such transformation have already been learned. Financial inclusion leads to an inclusive, stable, and sustainable system for managing finances which can go a long way in meeting the needs of the entire population including all segments and empowering them economically to sustain social stability. Bangladesh has not been this far without obstacles. Regulatory bodies as well as the government have always been and will be obligated to increase and retain consumers' confidence in the sector of financial services. Besides involving finance or money, this sector has a lot to do with people's trust. So, the country's priority is and will always be to uplift the trust and confidence of general consumers in the financial sector as part of its journey towards financial inclusion.

Advertise

Advertise