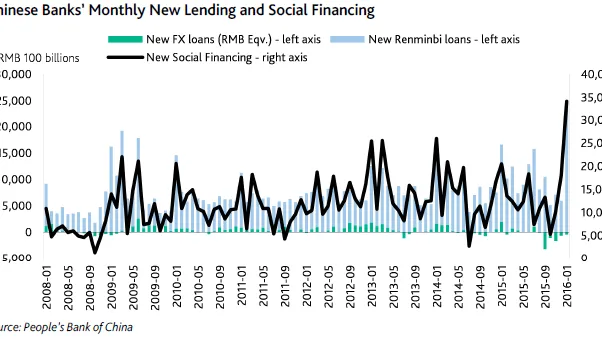

New RMB loans hit a record RMB2.51 trillion in January 2016

The pace of credit growth exceeds economic growth, analysts warn.

The People’s Bank of China's latest financial statistics report showed that new renminbi loans jumped to a record RMB2.51 trillion in January 2016 from RMB1.47 trillion in January 2015 and overall loan growth of 14.1% year on year in January 2016 compared to 13.7% a year ago.

Moody's Investors Services notes that this growth is credit negative for Chinese banks because it implies that the pace of credit growth exceeds economic growth, which will negatively affect banks’ capital and loan quality.

"Such loan growth is occurring at a time when China’s economic growth is slowing and inflation is low. Nominal GDP growth slowed to 6.5% in 2015 from 8.2% in 2014, and we forecast real GDP growth will slow to 6.3% this year owing to falling exports. With low inflation continuing, we expect the pace of nominal GDP growth to be similar. The faster than economic growth in overall credit is reflected in the reported growth in total social financing," adds Moody's.

Advertise

Advertise