Bottomline: An all-access pass to the global payments' highway

As new payment networks emerge, banks are seeing transactions move beyond SWIFT and traditional payment methods.

After an unprecedented double-digit (11%) growth in 2017, global payments revenue stabilised to 6% in 2018 to end at $1.9 trillion, according to McKinsey. With the negative impact of Coronavirus on worldwide trade and payment flows, the latest McKinsey forecasts show a dramatic decline, with total payments revenues dropping by as much as 8-10% this year, However, after a period of recovery, payment revenues are anticipated to return to historical levels and exceed them in due course.

The ramifications for incumbent and challenger banks are more transactions domestically and across borders. For banks, financial institutions (FIs), and other players, this means subscribing to, and investing in, networks and platforms to speed up financial messaging to connect payments faster and securely.

SWIFT, long considered the primary highway of moving global payments, continues to play a pivotal role in providing a secure messaging network to support both domestic and international payments, according to Marcus Hughes, Head of Strategic Business Development at Bottomline, an innovative payment processing company that is the largest SWIFT service bureau in the Asia Pacific.

However, several exciting initiatives are set to provide business customers with alternatives to SWIFT for cross-border payments, such as real-time payments, which are expected to open up competition and cooperation between incumbents and fintech firms as neo banks and big-tech-backed Payment Service Providers (PSPs) look to enter the fray.

In particular, Hughes noted India’s UPI, a system developed by National Payments Corporation of India, as setting the pace in terms of innovation, with 148 banks delivering fast and easy transactions.

In an interview with Asian Banking & Finance, Hughes talks about the emerging trends and technologies that are radically changing the way businesses pay and get paid, as well as how banks and financial institutions can leverage global connectivity to improve internal efficiency and create new revenue streams.

Please give us a brief background about Bottomline. What are the recurring pain points and strategic objectives that customers ask Bottomline to address? And what types of solutions do you recommend to support banks and other financial institutions who want an all-access pass to payment channels?

Bottomline provides cloud-based solutions which help organisations to efficiently make and receive payments. We serve banks, financial institutions and payment service providers (PSPs), as well as corporates. Our cloud-based applications span payments and cash management, corporate actions and market data, reconciliation, data transformation, cyber fraud prevention and AML compliance solutions. Globally, Bottomline has revenue of $420m and a market capitalisation of about $2b on NASDAQ, with 1,900 employees.

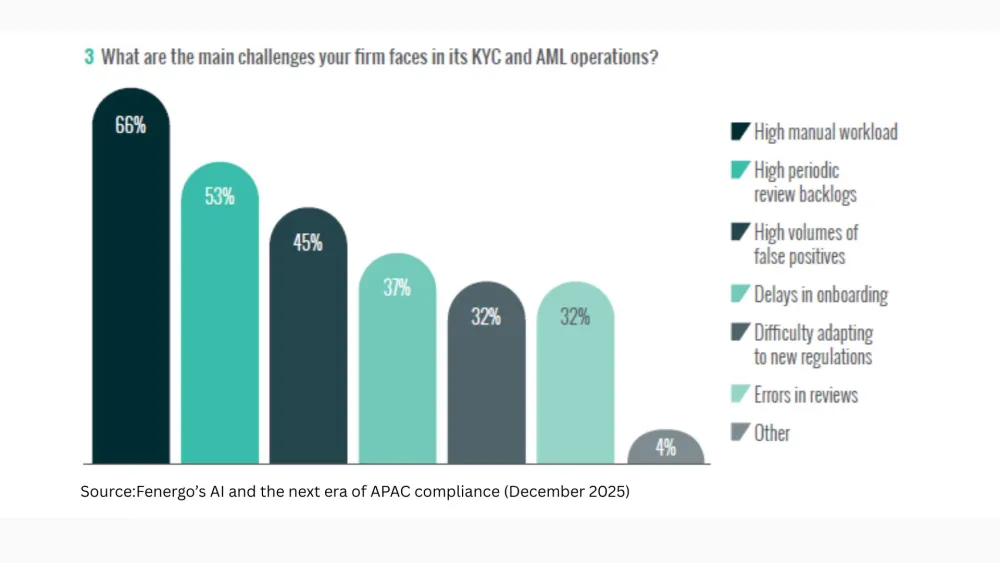

In today’s competitive markets, banks face several pain points, the greatest of which is regulatory compliance. Banking is highly regulated, and banks, therefore, have to prioritise compliance, which takes the lion’s share of the budget, to avoid hefty penalties and reputational damage for regulatory breaches. But this leaves limited funding for discretionary spend. This allocation of resources risks negatively impacting innovation, as banks wrestle with so many conflicting demands on their time and budgets. It is therefore vital for banks to find cost-effective ways to ensure their offering is competitive and up-to-date, as well as compliant with the minimal viable requirements. However, institutions should also plan for a more strategic implementation in the future to ensure they are maximising on new technologies, such as real-time, open banking and digital overlays.

Our experience is that these factors are highly compelling reasons for banks to partner with fintech firms with cloud-based technology which can integrate with legacy systems and enable digital transformation, with fast to market and innovative solutions. So, the lesson here is that banks can no longer do it all themselves. Such a strategy is simply no longer practical in an era of connected ecosystems and market places. Partnering with the right firms can make things easier.

Bottomline has a proven track record of helping banks and FIs with compliance, such as anti-money laundering requirements and machine learning functionality. Banks also look to us for innovative ways to solve customer pain points. Exciting new payment instruments are emerging, such as Request to Pay and Confirmation of Payee. But that’s just the starting point. These new instruments need to be built into value propositions, such as helping businesses to get paid quicker, making cash allocation easier or reducing the risk of fraudulent payments.

Can you tell us more about SWIFT’s shared infrastructure programme and Bottomline’s role as the only Service Bureau in Singapore?

SWIFT’s Shared Infrastructure Program (SIP) was created by SWIFT and its accredited partners to make it easier and more cost-effective for banks and corporates to access the benefits of the SWIFT secure financial messaging network. Bottomline is one of the largest SWIFT SIP providers in the world, with service bureaus in London, Geneva and Singapore—all serving customers globally. Our Singapore operation is the largest SWIFT service bureau in the Asia Pacific, serving over 200 banks, financial institutions and corporates. The APAC region has tremendous potential, with over 60% of the world’s population and non-cash payment transactions growing at over 30% per year, faster than anywhere else in the world.

What are the emerging trends in the payments landscape that have had the most impact on transaction banking? Can you elaborate on how blockchain and open banking or APIs can be utilised to further improve the payments process and generate new revenue streams?

The payments industry is going through a period of unprecedented change, driven by many factors:

- New regulations which encourage greater innovation and competition, such as Open Banking

- New entrants to the market, such as digital banks and non-bank fintechs

- New payment instruments and formats, such Request to Pay and Confirmation of Payee

- New technology, in particular, the adoption of cloud and APIs in financial services

- New central infrastructure payment systems in a growing number of countries

- The widespread roll-out of real-time payment systems

This powerful mix of factors is driving radical change in digitising the way businesses and consumers pay and get paid within the global banking and payments community. Initiatives such as Open Banking are creating a new and improved approach to sharing bank account information and giving customers greater control over their data via improved transparency and insight into their financial activity. The key objectives of such regulations are to increase competition and innovation, all while making payments simpler and safer. However, the real value of big data is to deliver a superior customer experience that allows you to stand above your competitors. Open Banking is already driving exciting new services and business models, based on platforms, market places and interconnected ecosystems. Many countries around the world are closely watching developments in the UK and Europe and designing their own versions of this new approach to managing data and digitising payments. Some of these changes are coming as a result of new regulations adopted in other countries, but in other cases, it is merely competitive forces which are driving innovation.

What other innovations (instant or real-time payments) are banks and financial services adopting to engage more customers? Can you tell us more about these disruptive advancements?

Many exciting innovations are being introduced, which radically changes the way businesses pay and get paid. One of the most critical developments in the payments landscape is the widespread adoption of real-time payments, available 24/7. Also, there is a range of new payment instruments which we are developing with our banking partners globally to future-proof for future payments modernisation. For example, Request to Pay is a flexible new way of getting paid, which will complement, but not replace the Direct Debit. On receiving a Request to Pay on his or her mobile phone, the debtor can decide whether to pay the whole amount immediately, to make a partial payment or opt for deferred payment, as well as rejecting the payment altogether. This gives the payer greater flexibility than under current models. Confirmation of Payee, a payee verification solution, will provide greater certainty that payments reach the party they are intended for. Another new instrument, known as Enhanced Data, will provide explanatory information on what the amount relates to (such as paying several invoices) and will make it easier to reconcile incoming payments.

With the advent of multiple ways and channels to connect payments and transactions, can you please elaborate on how Bottomline provides ‘an all-access pass’ to the payments’ highway? Can you share specific use cases of how Bottomline made a positive impact to a company's business (e-commerce, merchants and banking)?

Using our award-winning Universal Aggregator platform, we make it easy for customers to access multiple payment and securities systems, quickly and cost-effectively in a payment hub environment. The wide range of networks and protocols includes SWIFT, real-time payments, Euroclear, CREST, and our latest addition Visa B2B Connect. We also have the flexibility for other networks to be added according to customer demand and an individual company’s strategy. We are working with several large corporate customers, such as online merchants and cross-border PSPs, to help them to reduce the high card fees they pay. This is achieved by making it easy for their end customers to use account-to-account payments, instead of using cards. These services to corporates can be white-labelled by banks to enhance their payments value propositions.

In addition to the SWIFT financial messaging network, who are the new key players that are gaining traction and demand from customers?

SWIFT continues to play an essential role in providing a secure messaging network to support both domestic and international payments. This capability has undergone a significant upgrade over the last few years, with the launch of SWIFT gpi, which stands for Global Payment Innovation. Originally a defensive measure against the supposed threat of blockchain payment initiatives such as Ripple, SWIFT gpi has proved highly successful in making cross-border payments faster, more efficient and easier to trace. In just 3 years since its launch, gpi is already proving to be the new norm in cross-border payments. Payments are now typically settled within minutes or even seconds, while banks can track their payment flows end-to-end, in real-time. SWIFT gpi now has over 3,900 members and processed $77 trillion of global payments in 2019 (almost double the $40 trillion of gpi payments in 2018). By the end of 2019, two-thirds of all SWIFT’s global payment messages were sent via gpi. Bottomline’s bank and PSP customers are all keen to not only take advantage of the scale of the opportunity but also use the transparency of the required messaging standard of ISO 20022 to improve operational efficiency and customer experience.

However, there are several exciting initiatives which look set to provide business customers with alternatives to SWIFT for cross-border payments. A good example is our Visa B2B Connect partnership which enables banks to access a new payments network, offering integrated foreign exchange settlement and robust security features. We’ve also partnered with Currency Cloud to provide our corporate customers with an easy to use international payments service, with competitive FX rates.

As big tech companies look to set up payment ecosystems of their own and with digital licenses set to be rolled out, how can banks stay competitive when more agile players enter the fray?

With such a busy schedule, it is not surprising that some banks and businesses are feeling increased pressures, in some cases leading to a sense of project overload. There has, therefore, never been a time of greater need for trusted advisers which can make it easier and faster for banks and businesses to remain competitive and comply with new requirements. By working with a service partner to help develop winning propositions for their ever more demanding customers who expect their payment solutions to be instant, smart and secure, banks and FIs can ensure they are employing best practices on implementation for now, while building a platform for future strategies.

Many banks initially treated requirements like Open Banking as just another compliance exercise. But now the more commercially minded banks realise that it is strategically important to be proactive and to innovate to win and retain customers. In other words, they recognise it isn’t just a case of ‘ticking the box’ and being defensive by doing the minimum to comply with open APIs, Strong Customer Authentication and Transaction Risk Analysis.

When Open Banking was first discussed, it was widely suggested that a new breed of start-up fintech firms would move so fast and take over incumbent banks. However, the market has moved in a different direction, and much of this hype is proving to be exaggerated. To a large extent, previous concerns about fintech firms “eating the bankers’ lunch” have now evolved into a more mature phase where fintech and bankers are partnering with each other. Several well-established fintech firms have already established strong relationships with banks to which they provide valuable solutions, often on a white-labelled basis. At Bottomline, we have been doing this for years, and these well-established partnerships are now more important than ever.

Bottomline recently acquired a Cyber Fraud and Risk Management solution provider. Can you tell us more about this acquisition?

Intellinx, an Israeli specialist software provider, which Bottomline acquired a few years ago, has been fully integrated into our solution set and helps banks and businesses protect themselves against the risks of cyber fraud relating to payments and reduces breaches of Anti-Money Laundering (AML) regulations. With the increase in cyber fraud, it is essential that banks and businesses “up their game” to ensure they have multiple layers of defence in place to keep ahead of the fraudsters. Obviously, security policies and procedures, as well as training, are all vital for protecting an organisation against cyber fraud. But technology also has a critical role to play—it is essential to encrypt data, at rest and data in transit. But it is not just a case of protecting customer data, it is also vital to do everything possible to detect and prevent fraudulent payments. Payment systems must have a secure internal control framework, like secure access, segregation of duties, four eyes approval workflow, full audit trail and multifactor authentication (MFA).

Another valuable technique is to deploy transaction and user behaviour monitoring, which helps to detect unusual activity. This strategy should form a central part of a bank’s layered cyber defence. Advanced analytics and profiling of user behaviour and transactions enable a system to understand normal transaction patterns and user activity. This data is then used as the basis for detecting abnormal and potentially fraudulent transactions in real-time. A powerful fraud analytics solution combines rules-based detection with machine learning which enhances the rules engine to reduce false positives, by updating the system continuously. Today, a payment fraud prevention system must have the ability to flag suspicious transactions and block potentially fraudulent payments in real-time. This is because suspicious transactions must be stopped before they are released onto the payment network. One worrying aspect about increasing adoption of real-time payments is that faster payments can also become “faster fraud”. With real-time payments, there is a real-time risk of fraud because of the zero to 15-second transaction time and the fact that a payment is irrevocable. Hence, as successfully demonstrated by the participants of the UK Faster Payments Scheme, control systems need to operate in real-time and collaboration between members is paramount.

How do you see global payments evolving in the next 3 years, and what is Bottomline doing to support its customers in staying ahead of the game?

The introduction of real-time payments systems in countries like Singapore, Hong Kong and Australia is driving the emergence of a new generation of neo banks, typically without any bricks and mortar branches. This is creating an environment like the UK, where so-called “challenger banks” are developing innovative propositions for highly segmented target audiences. We have helped many new digital banks and non-bank PSPs access real-time payment systems quickly and cost-effectively, using our cloud-based Universal Aggregator.

As the UK is the first country to embark on Open Banking, our early and comprehensive experience in this exciting journey will be very useful in developing best practices, not only in the UK but also in other geographies as it is adopted around the world. Other countries adopting Open Banking include Australia, Canada, Hong Kong and Singapore, while Japan and South Korea are also planning new regulations for Open Banking. In the UK, Bottomline is already able to deliver innovative solutions as an Account Information and Payment Initiation Service Provider. This positions us to offer a range of innovative services for our bank and corporate customers, and we believe a similar model is likely to be increasingly adopted in the APAC region.

Bottomline’s strategy is to support its customers by anticipating changes in the market and insulating them from the complexity of these changes. This partnership relates to compliance with new regulatory requirements and the integration of new payment systems and technologies. This mission is complemented by ensuring that our customers get the maximum benefit and value from the opportunities presented by the evolving global payments ecosystem.

To find out more, download the Global Payments & Banking 2020 Report or book a meeting to see how Bottomline can partner you to success on +65 6508 8088 or visit their website.

Advertise

Advertise