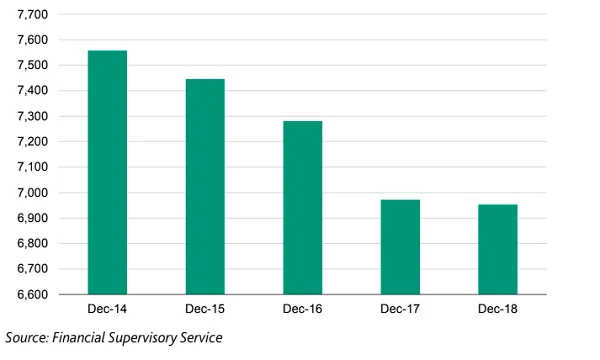

Chart of the Week: How many branches do Korean banks have left?

The number fell from as high as over 7,500 in 2014.

Like most of their peers in Asia, Korean banks have been gradually trimming down their branch networks as part of a cost rationalisation exercise that aims to integrate more technologies into bank processes. As of December 2018, the number of bank branches fell to below the 7,000 mark from as high as 7,500 in 2014.

Also read: MUFG to close 80 more branches

The number of employees working for the country's banking system also dropped from over 118,000 in 2014 to 110,346 in September 2018.

A separate study by corporate tracking firm CEO Score cited by The Korean Herald noted that Korea's banking and finance industry workforce numbers dropped 4% in Q3 2018 compared to the previous quarter in 2016, with the employee pool of the five major banks shrinking by 9.2% or 5,726 employees over the two-year period.

Banks have been stepping up their digital transformation agendas, alloting an average of $20.44m (KRW23.6b) of their 2019 budget. This represents just 1.1% of average net profit generated by the country's four largest commercial banks in 2018 but 13.6% of six regional banks, highlighting the profit strain on smaller players.

Also read: Is branch banking still relevant as lenders migrate services online?

"One development that could accelerate incumbent banks’ digitalisation is the new labor law, effective 2019, which limits weekly work hours to 52. We expect the resultant rise in labor costs to drive broader use of new technologies by banks to improve efficiency," Moody's said in the report.

As a result, banks will steadily adopt robotics process automation (RPAs) in their internal processes to expand to more sophisticated functions such as loan approvals, account activities surveillance and the conduct of due diligence. "The new labor law could slow the fall in banks' aggregate payrolls but also promote faster and broader adoption of automation, which will limit the need for new hires," concluded Moody's.

Advertise

Advertise