Public Bank launches new lifestyle debit card for frequent travellers

The bank partnered with UnionPay International.

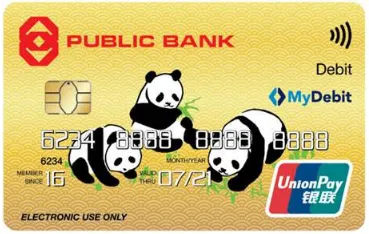

UnionPay International (UPI), a global payment network, has reaffirmed its presence in Malaysia by inking a first-of-its-kind partnership with Public Bank (PB), the third largest bank in Malaysia. The two collaborated to launch the PB UnionPay Lifestyle Debit Card in December 2016, targeted at customers and businessmen who are frequent travellers to Asia.

Poised as the best travel companion, the PB UnionPay Lifestyle Debit Card which is issued upon opening of a PB UnionPay Savings Account, will give Cardholders access to a range of perks and benefits. A PB UnionPay Lifestyle Debit Cardholder can access the Priority Lane at the Chinese Visa Application Service Centre in Kuala Lumpur and Kuching, to expedite the submission and processing of visa applications.

Besides, discounts of up to 10% are offered to these Cardholders at duty-free shops in 100 participating international airports. PB UnionPay Savings Account offers a flat interest rate of 0.5% per annum, and a monthly cash rebate of RM10 (S$3.21) for accounts with a minimum of RM10,000 (S$3,221) month-to-date average balance and no over-the-counter transactions for the month.

In conjunction with the launch, Public Bank is offering complimentary access to Plaza Premium Lounge Malaysia so visitors can partake in a host of facilities that will make traveling more comfortable and satisfying. A panda neck pillow and eye mask resembling the card design will be given to new PB UnionPay Savings Account holders with a minimum deposit amount of RM2,000 (S$643) which is earmarked for three months. Gifts are available while stocks last.

Public Bank is the third largest banking group in Malaysia. Headquartered in Kuala Lumpur, Malaysia, the Bank entered its 50th year of operations in 2016 with a total group asset size of RM363.76 billion (S$116 billion) as of end 2015.

With an extensive reach to its customers via a network of 259 well distributed branches and over 2,000 self-service terminals in Malaysia, this partnership between UPI and PB aims to provide PB customers with greater mobility within the region through the use of its high quality and secure cross-border payment services.

“We are excited to have Public Bank on board as our strategic partner for our issuing in Malaysia,” said Mr. Wenhui Yang, General Manager of UPI Southeast Asia. “UnionPay International is fully aligned with Public Bank’s focus on providing the most efficient services to its customers through the innovation of new banking services, and we believe that this partnership will put us in a good position to serve the needs of consumers and businesses in Malaysia.”

“We are proud to be the first local bank in Malaysia who had launched UnionPay Card which offers various solutions to fit our customers’ financial and lifestyle needs. With the expanding business alliances between China and Malaysia, Public Bank continues to progress and expand in order to become the first choice of expatriates and students from China for their banking service needs as this card serves them well whenever they are in China, Malaysia or any other 160 countries and regions that accept UnionPay Cards.” said Y. Bhg. Dato’ Chang Kat Kiam, Deputy Chief Executive Officer of Public Bank.

Advertise

Advertise