Chart of the Week: Australia’s card payments to rise 8% in 2024

Debit cards rise with Australians reluctant to take on credit card-related debt.

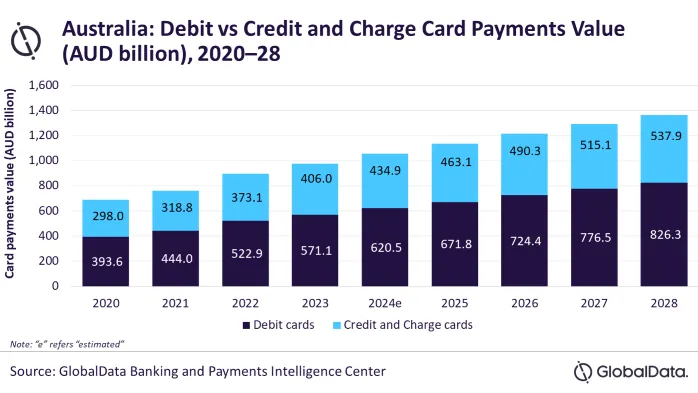

Australia’s card payments market is expected to grow by 8% and reach $701.2b (A$1.1t) in 2024, reports data and analytics company GlobalData.

The market has grown at a compound annual growth rate (CAGR) of 9.2% between 2019 and 2023 to reach $649.2b (A$977.1b) in 2023.

Growth is supported by Australians’ nearly 100% banked population and high frequency of card use. As of 2023, Australians hold an average of two cards per person, GlobalData found.

Australians also use their cards the most frequently in the Asia Pacific, at an average of 229.2 times– the highest in the region.

ALSO READ: South Koreans’ card spending up 32% to $19.22b in 2023: report

“The surge in payment card usage is attributed to the convenience of electronic payments, a strong POS infrastructure, the growth of the ecommerce market, and high consumer preference for contactless payments,” notes Shivani Gupta, senior banking and payment analyst at GlobalData.

Contactless card payment has also become a mainstream payment in Australia and is widely used, GlobalData said. Contactless card payments made up 95% of all in-person card transactions in 2022.

This, in turn, drove up the use of card payments even for “low value transactions” that was previously dominated by cash. According to a 2022 survey by the Reserve Bank of Australia, more than 70% of low value payments worth A$10 ($6.64) or less were made using payment cards in 2022 – up from nearly 50% in 2019.

Debit cards accounted for 58.4% of card payment values in 2023.

ALSO READ: What Singapore’s property developers can learn from Japan’s Azabudai Hills

“Amidst the economic slowdown and high inflation, consumers are increasingly spending within their means rather than relying on debt, resulting in the higher usage of debit cards,” Gupta noted, adding that Australians also use their debit cards most frequently in APAC, at 238.9 times on average in 2023.

To compare, none of its major regional peers break the hundreds in terms of using their debit cards to pay: Singapore (85.4), South Korea (64.4), New Zealand (52.4), Malaysia (32.3), Hong Kong (China SAR) (28.6), China (20.0), and India (3.5).

Credit and charge cards, meanwhile, accounted for 41.6% of the card share. This is lower than the 48.7% in 2019. Consumers are reluctant to take on more credit card debt, and the growing popularity of buy now pay later (BNPL) also dented credit card use.

Advertise

Advertise