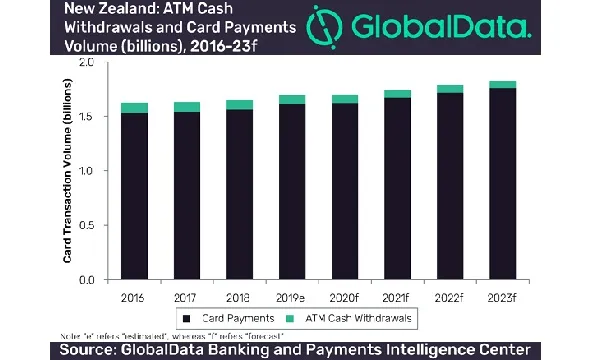

Chart of the Week: New Zealand card payments to grow 2.2% annually through 2023

The pandemic will slow card payments adoption as consumers switch to online payments.

New Zealand’s card payments at point-of-sale (POS) systems are expected to rise at a compound annual growth rate (CAGR) of 2.2% during the same period, according to a report by data and analytics company GlobalData.

ATM cash withdrawals are predicted to decline at a CAGR of -4.8% between 2019 and 2023 over the same period.

The slow growth of card payments is impacted due to an overall decrease in consumer spending as a result of the COVID-19 pandemic, noted Ravi Sharma, lead banking and payments analyst at GlobalData.

“Whilst card transactions continue to grow at the cost of cash, the growth is likely to be slower because of the overall decrease in consumer spending. Payments companies will lose out on significant business from sectors, such as travel and tourism, accommodation and retail, which have been hit the hardest due to the lockdown to control COVID-19 outbreak,” Sharma said.

GlobalData noted that consumers are switching from in-store to online purchases in order to avoid exposing themselves to disease vectors such as cash and POS terminals. With local stores running out of stock due to delayed shipments, consumers are opting for online purchases to stockpile items and to avoid busy public places.

As a result, popular online checkout solutions similar to PayPal, Visa Checkout, POLi, and Masterpass could potentially benefit from the prevailing trend, the report added.

“With New Zealand imposing lockdown for one month on 25 March 2020, there will be a decline in the overall consumer spending, impacting the overall payment volume. Payments sector is expected to revive gradually by the end of Q2 2020 once lockdown is completely lifted and the market scenario normalises,” concluded Sharma.

Advertise

Advertise