Chart of the Week: Thai card payments market to shrink 3.5% in 2021

Recovery is not expected to begin until end-2022, says GlobalData.

Thailand’s payment card market is expected to continue shrinking in 2021, with recovery set from 2023 at the latest, reports data and analytics firm GlobalData.

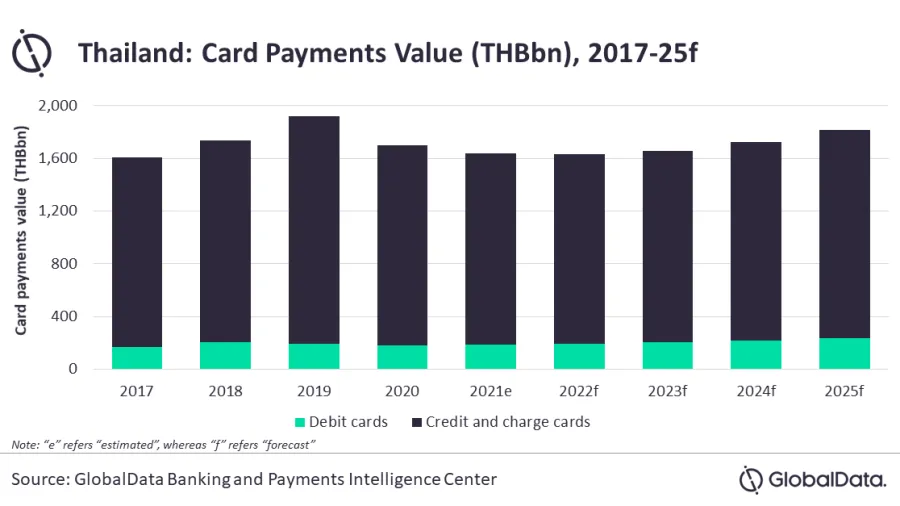

Payment card transaction values dropped 11.7% in 2020, reversing years of robust growth pre-pandemic. The recent "third wave" of COVID-19 infections is expected to continue dampening consumer spending. As a result, card payments value in Thailand is estimated to decline by 3.5% to reach $54.6b (THB1.6t) in 2021.

The country’s card payments market is not expected to reach its pre-COVID levels anytime soon, said Nikhil Reddy, a senior payments analyst at GlobalData, given that the economy had just contracted 6.1% in 2020.

“As Thailand is currently struggling to contain the third wave, recovery in card payments looks uncertain at least by the end of 2022,” said Reddy.

Due to resurgence in new cases, the central bank of Thailand has revised downward its gross domestic product forecast for 2021, from 1.8% released in July 2021 to 0.7% in its August 2021 estimates.

Credit and charge cards are the most preferred card types for payments in Thailand primarily due to the reward benefits such as discounts and cashback, and instalment payment facilities offered on these cards. These cards account for 88.7% of all card payments by value in 2021. Debit cards account for the remaining 11.3% share.

Lockdown and travel restrictions have affected consumer spend on merchants such as airlines, hotels, restaurants, and transportation, which, in turn, resulted in reduced credit and charge cards’ usage.

Advertise

Advertise