Consumer spending to spur growth in Taiwan card payments

The value is expected to reach $200.2b by 2024 at a CAGR of 7.6%.

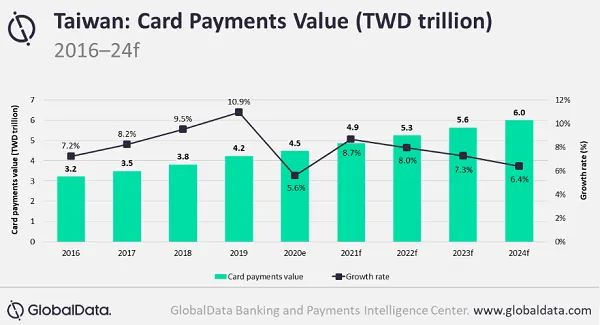

A rise in consumer spending on the back of stimulus measures and easing travel restrictions will spur card payments in Taiwan, with the value growing 5.6% this year, reportsGlobalData.

The value is expected to reach $200.2b (NT$6t) by 2024 at a CAGR of 7.6%.

Fears of the virus spreading through cash and government measures pushing card payments are the main drivers of growth, said analyst Nikhil Reddy, despite the country only having a low frequency of 8.5 transactions per card yearly in 2019.

Further boom in e-commerce is also expected to benefit card payments, with credit and debit cards collectively accounting for a quarter of e-commerce payments in the country. E-commerce spending is expected to grow by 11.6% in 2020 compared to the earlier forecast of 9.7%.

The government has rolled out a “triple stimulus” programme that lets people buy TWD3,000 $100.19 (NT$3,000) worth for $33.40 (NT$1,000). Individuals holding credit cards from 38 participating banks can register for this program. On spending $100.19 (NT$3,000) between 15 July and 31 December 2020 via the registered credit card, $66.79 (NT$2,000) will be credited back as cashback on credit card account, the report said.

Advertise

Advertise