India’s buy now pay later market to be worth $15b in 2026: analyst

Amazon Pay Later has over 3.7 million registered users in 2022.

India’s buy now pay later market is estimated to grow over twofold in 2022 amidst growing demand amongst locals for an option to pay purchases at a later date.

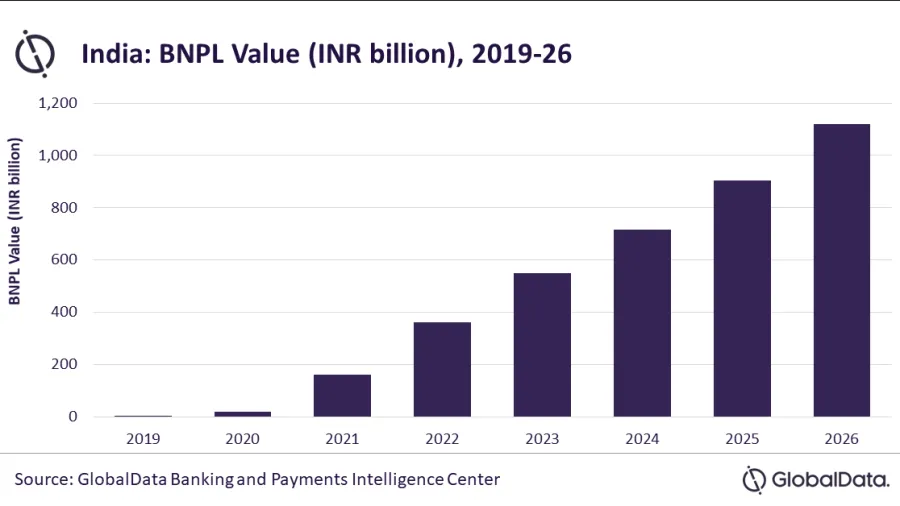

The BNPL market is estimated to grow 125.8% and reach $4.9b (INR363b) by the end of the year, according to data and analytics company GlobalData.

“BNPL, which is already very popular in Australia and many European markets, is gradually gaining traction in India, especially among millennials. It provides consumers with the flexibility to pay for purchases at later dates with no-interest, making it a lucrative payment tool, particularly for those who do not own credit cards,” said Shivani Gupta, senior banking and payments analyst at GlobalData.

ALSO READ: Gap to widen between India’s public and private banks: S&P

“Furthermore, with [the] pandemic adversely affecting consumers’ disposable income, the demand for short-term consumer financing solutions has increased in the past couple of years,” Gupta added.

The market is expected to grow at a compound annual growth rate of 32.5% between 2022 and 2026 and be worth $15b in 2026, driven by increased demand for short term credit coupled with growing consumer preference for online shopping, GlobalData said.

Major BNPL brands in India include Amazon Pay Later, ZestMoney and Flipkart Pay Later. Amazon Pay Later now has over 3.7 million registered users in just two years since launch, driven by a faster customer sign-up process, and its wider use cases for goods purchases and utility payments.

Advertise

Advertise