India’s credit and charge card payments market to grow 15.5% in 2024

Credit and charge cards accounted for 75.7% of total card payment value in 2023.

India’s credit and charge card payments market is expected to be worth $270.4b by end-2024, growing 15.5% compared to a year earlier, according to GlobalData.

This extends the market’s growth trajectory after recording a 48.1% growth in 2022 and a 27.8% growth in 2023, the data and analytics company said in a press release.

Credit and charge cards accounted for 75.7% of the total card payment value in 2023. Payment frequency for these cards stood at 35.9 times in 2023 and is expected to reach 37.6 transactions per card in 2028.

They also accounted for 15.4% of the total e-commerce transaction value in India in 2023, according to GlobalData’s 2023 Financial Services Consumer Survey.

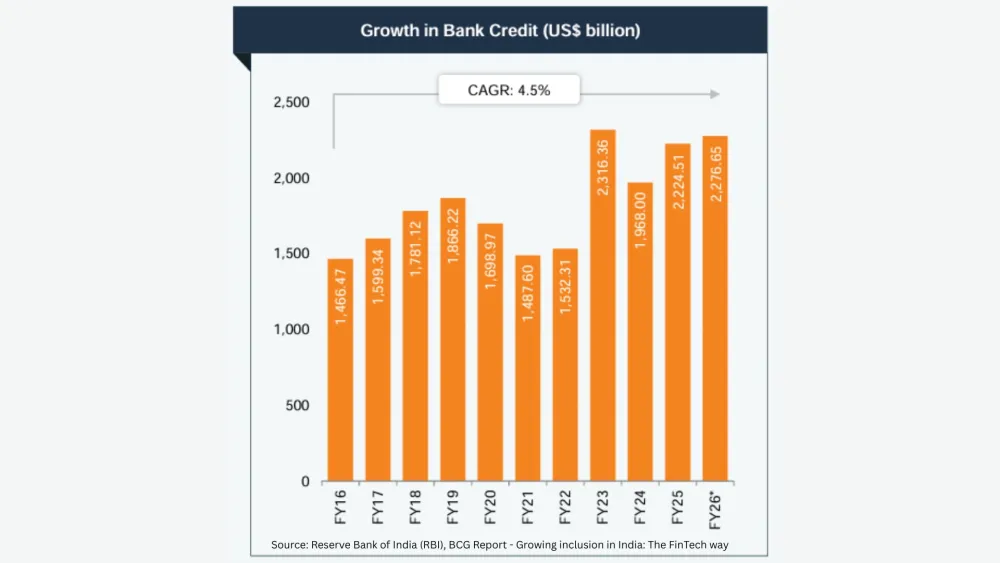

Overall, the credit and charge card payments value are expected to grow at a compound annual growth rate (CAGR) of 12.6% between 2024 and 2028, said Ravi Sharma, lead banking and payments analyst at GlobalData.

“Availability of flexible payment options is also contributing to the rise in usage of credit cards. Indian consumers are increasingly opting for installment payments, with almost all major banks in the country offering credit card holders the option to convert large-ticket purchases into monthly installments,” Sharma said.

Advertise

Advertise