OCBC launches near-instant P2P transfers to WeChat Pay and Alipay

It also aims to expand the service in Indonesia and the Philippines by 2026.

OCBC has launched a new service on its mobile banking app, allowing customers to make near-instant peer-to-peer transfers to WeChat Pay and Alipay using the recipient's China national ID number and mobile number.

This capability, powered by Visa Direct, caters to increasing remittance flows from Singapore to China, with OCBC noting a 50% rise in such transactions amongst its Singaporean customers over the past year.

The new pay-to-wallet service enables transfers to be completed within seconds, significantly faster than the usual two to five days required by other methods. It also eliminates the need for customers to carry cash to non-bank remittance outlets for cross-border transfers.

OCBC plans to expand this service with Visa Direct to support popular digital wallets like GoPay and OVO in Indonesia, as well as GCash, PayMaya, and Coins in the Philippines by 2026.

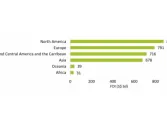

With access to over 50 digital wallets across Asia Pacific, OCBC aims to accommodate growing customer demand, as monthly cross-border transfers from Singapore to ASEAN markets have grown by an average of 10% over the past year.

Advertise

Advertise