OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912.

See below for the Latest OCBC Bank News, Analysis, Profit Results, Share Price Information, and Commentary.

OCBC hit with complaint over coal power financing in Indonesia

OCBC hit with complaint over coal power financing in Indonesia

The complaint notes it excludes financing for new coal plants under its framework.

1 day ago

OCBC’s net profit dip 2% to $5.87b on higher tax expenses

OCBC’s net profit dip 2% to $5.87b on higher tax expenses

1 day ago

Singapore banks lead pay as hiring access ranks low

DBS and OCBC were at the bottom 20% for job opportunities to non-degree holders and less experienced workers.

2 days ago

OCBC new investors triple as bank braces for 2026 gold, silver uptick

The bank sees sustained growth on the back of industrial use and recent price rallies.

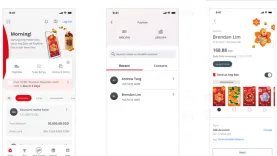

OCBC enables Weixin Pay QR payments via bank app

Customers will see rates in real-time before making a transaction.

UOB set for growth as DBS, OCBC earnings hold steady: report

The sector benefited from dividend potential and provision write-backs.

E-ang bao use jumps nearly 50% in 2025 as seniors ditch red packets: OCBC

Nearly 8 in 10 seniors were first-time e-ang bao senders, OCBC said.

OCBC opens client stocks to institutional borrowers via Citi platform

The securities lending market generated $1.2b of revenue in December 2025 alone.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Overall fee income is expected to expand at a double-digit rate of 31% this quarter.

OCBC sets up securities financing unit to mobilise idle assets

Customers have the chance to earn fee income from lending out their idle securities.

Bank of Singapore appoints OCBC veteran as global CFO

Collins Chin worked at OCBC for over 16 years before taking on this new role.

Three Singapore banks pull $3.0b in net retail inflows

DBS Group Holdings was the largest recipient of net retail inflows.

Singapore big three banks to sustain strong dividends in 2026: report

Wealth management inflows and activities are expected to be robust.

This week in finance: TenPay Global CEO on interoperable payments; tap-to-pay service roll-outs

OCBC and Vietnam separately strengthen their QR payment ties with China.

This week in finance: CIMB Singapore's new card for sole proprietors; banks' real estate woes; in-app chat services heat up

GoTyme Bank is now compatible with Google Pay.

OCBC rolls out in-app calls for retail customers

In-app calls will not incur International Direct Dialling (IDD) charges.

OCBC adds 8 SEA e-wallets in digital app

Customers in Singapore can now directly transfer money to 10 e-wallets.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership