CareEdge

CareEdge is a knowledge-based analytical group offering services in Credit Ratings, Analytics, Consulting and Sustainability. Established in 1993, the parent company is CARE Ratings Ltd (CareEdge Ratings).

The wholly-owned subsidiaries of CareEdge Ratings are (I) CARE Analytics & Advisory Private Ltd previously known as CARE Risk Solutions Pvt Ltd, and (II) CARE ESG Ratings Ltd, previously known as CARE Advisory

Research and Training Ltd. CareEdge Ratings’ other international subsidiary entities include CARE Ratings Africa (Private) Limited in Mauritius, CARE Ratings South Africa (Pvt) Ltd, and CARE Ratings

Nepal Limited.

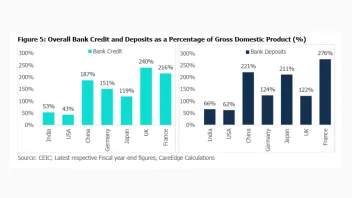

How India’s 53% credit-to-GDP ratio exposes a lending gap

How India’s 53% credit-to-GDP ratio exposes a lending gap

Formal borrowing is expanding but still trails the scale of domestic economic activity.

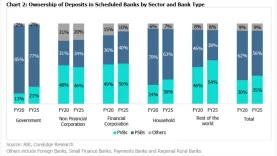

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership