Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

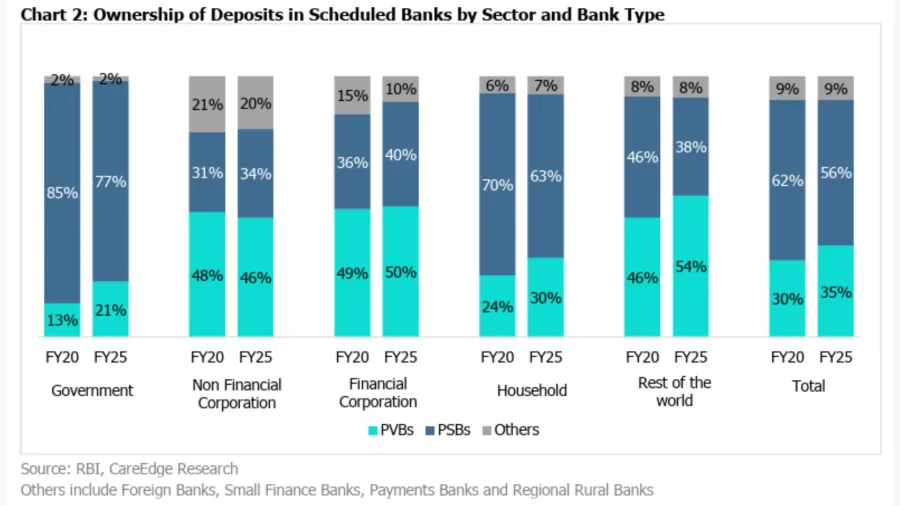

Private-sector banks in India have steadily increased their share of household deposits, rising from 30% in fiscal year 2020 (FY 2020) to 35% in FY 2025.

This growth has been supported by branch expansion, digital banking services, and customer-focused strategies, according to CareEdge Ratings.

Public-sector banks, while still holding the majority of deposits, have seen their share fall from 62% to 56% over the same period, reflecting a shift in depositor preference towards private lenders for convenience, service quality, and innovative products.

Private banks have invested heavily in digital infrastructure, offering mobile apps, internet banking, UPI, video KYC, and AI-enabled customer support.

They have also introduced personalised dashboards, faster grievance resolution, dedicated relationship managers, and bundled products such as savings accounts linked with insurance or rewards cards, improving engagement and satisfaction.

Between FY 2020 and first half of FY 2026 (H1 FY 2026), private banks’ deposits grew by about 15.2%, though growth moderated to a CAGR of around 14% from FY 2022 to H1 FY 2026.

Their branch network increased by roughly 7% over the same period, while average deposits per branch rose from about $1.54b (₹140 crore) in FY 2022 to $1.93b (₹175 crore) in H1 FY 2026, highlighting improved branch productivity.

In contrast, public-sector banks recorded slower deposit growth of around 9% between FY 2022 and H1 FY2026.

Their branch expansion was minimal, increasing by just 1% as many banks rationalised or consolidated outlets.

Average deposits per branch grew from about $1.25b (₹114 crore) in FY 2022 to $1.63b (₹148 crore) in H1 FY2026, indicating that growth came mainly from higher productivity at existing branches rather than network expansion.

The trend shows a dual growth dynamic for the banking sector: new branches drive market penetration, while existing branches boost deposit mobilisation.

Private banks’ expansion has been concentrated in urban and metro areas, with branch growth at a CAGR of 8% and 7.8% respectively between FY 2022 and H1 FY2026, reflecting a focus on regions with higher household income and digital adoption.

($1.00 = ₹91.60)

Advertise

Advertise