Event News

ABF Corporate & Investment Banking Awards 2024 Winner: PT Indonesia Infrastructure Finance

ABF Corporate & Investment Banking Awards 2024 Winner: PT Indonesia Infrastructure Finance

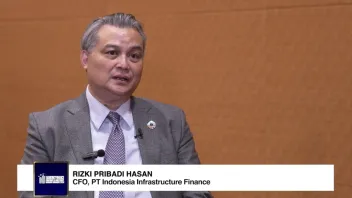

Rizki Pribadi Hasan, CFO at PT Indonesia Infrastructure Finance, spotlights their Green Perpetual Notes in Indonesia where customers will receive long-term funding and better rates to finance their infrastructure projects sustainably.

Liew Nam Soon delves into digital strategies and their impact on customers

He discussed the five sector-specific developments that financial services organisations across Asia-Pacific need to manage to be successful.

UNO Digital Bank bags Digital Banking Award - Philippines with its inclusive services

It brought home the ABF Fintech Award 2024 for disrupting the Philippine financial landscape by providing greater inclusivity and accessibility.

Mashreq Private Banking celebrates Excellence at the ABF Retail Banking Awards 2024

The bank’s solutions have brought significant value to clients and other stakeholders.

Mashreq solidifies position in SME banking with suite of enhancements

Its innovations have provided the sector with a wider array of banking services, improved access to banking, and enhanced customer experience.

The Future of Payments: Ensuring Stability, Embracing Innovation

As technology continues to evolve, financial institutions must persist with refining seamless and secure payment experiences for consumers.

Deloitte leader: Starting small, scaling up key to staying ahead in business

This comes as market activities compel banking and finance companies to align technological advancements in the industry with their respective business goals.

UOB secures major wins at ABF Wholesale Banking Awards 2024

UOB excels in AI, Digital Transformation, and Health & Wellness, showcasing its leadership in innovation and its dedication to comprehensive employee well-being.

Mashreq bags Open Banking Initiative of the Year - UAE at ABF Retail Banking Awards 2024 for its innovative Global Non-Resident Platform

The initiative transforms the Non-Resident banking experience globally with seamless, secure, and personalised services.

Financial services industry sees shift to digital, partnership-led business models, says PwC Partner

Industry innovations have become increasingly focussed towards customer centricity amidst keeping pace with evolving needs.

PT Indonesia Infrastructure Finance's groundbreaking achievements recognised at ABF Corporate & Investment Banking Awards

This highlights their pioneering efforts in sustainable finance and innovative deal-making.

Asian Banking & Finance and Insurance Asia Forum 2024 arrives in Manila this October

Join us as we chart the course for a resilient, innovative, and thriving future in the financial sector.

BDO wins big at the Asian Banking & Finance Awards 2024 with groundbreaking innovations

Pioneering financial education, wealth management excellence, and cutting-edge retirement solutions propel BDO to the forefront of the banking industry.

Here's why you shouldn't miss the 2024 Asian Banking & Finance and Insurance Asia Summit

Shape the future of financial services in Asia at the region's premier banking, finance, and insurance summit.

Hang Seng Bank sets benchmark in digital currency innovation with top honours at ABF Fintech Awards 2024

The Bank receives Digital Currency Award for its role as a leading advocate of central bank digital currency, through a hypothetical e-HKD-based e-Wallet prototype and demonstration of associated use cases.

CTBC Bank bags two wins at ABF Fintech Awards 2024

It redefines banking with strategic collaborations and tailored financial services.

Outstanding banking and finance industry champions crowned at Asian Banking & Finance Awards 2024

The 2024 Wholesale Banking Awards, Retail Banking Awards, Corporate and Investment Banking Awards, and the inaugural FinTech Awards recognised the industry's top performers for their innovation, dedication, and exceptional client service.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership