Artificial Intelligence can fill the crevices in the banking industry: UnionBank exec

Other potentials of AI in banking could help reach broader markets in the underserved segment of the country.

The risks of artificial intelligence (AI) will always be present, however, its untapped potential could also mean personalised virtual assistance, determining crimes in the financial atmosphere, and maximising alternative data.

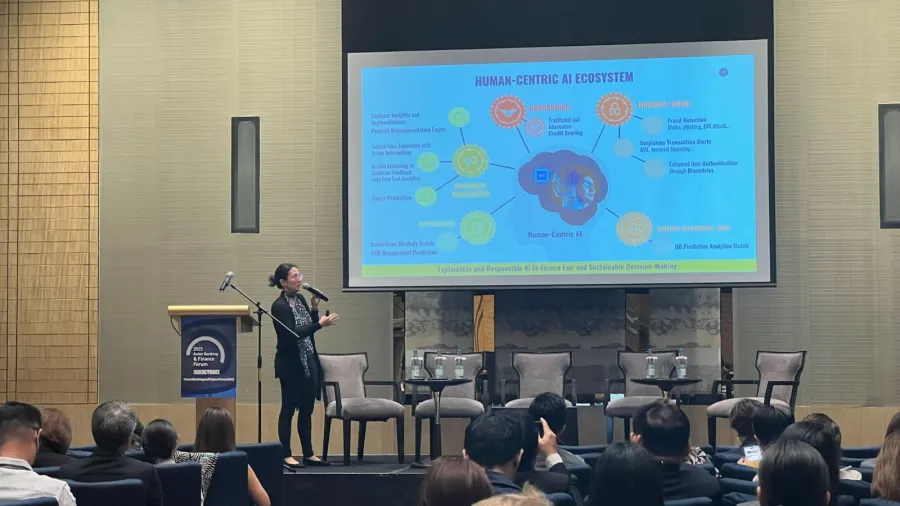

Perspectives on AI and how it can be maximised were shared by AI and Innovation Center of Excellence Head at UnionBank, Adrienne Heinrich at the 2023 Asian Banking and Finance forum in Manila.

Heinrich also emphasised the transformative potential of AI, especially in the context of personalised virtual assistants. She began her address by highlighting the growing importance of AI and how it is poised to reshape various facets of banking.

In particular, she predicted that smart, personalised virtual assistants would become a cornerstone of future AI applications.

She then engaged the audience by posing a thought-provoking question on the essential qualities of an effective virtual assistant. Attendees had the opportunity to provide their input through a live poll, shedding light on their preferences and expectations.

The poll results revealed that the audience had high standards for virtual assistants.

They expected these AI-driven entities to understand queries better than current chatbots, respond as quickly as cutting-edge AI like ChatGPT, maintain 100% accuracy, and emulate the customer service experience of a human agent.

The demand for empathy in virtual assistants also surfaced, indicating a desire for a more human-like interaction. Additionally, attendees expressed an interest in virtual assistants continually learning to better serve their needs.

AI in banking

Heinrich then delved into the various applications of AI within the banking ecosystem.

She discussed how AI could aid in alternative credit scoring, enabling those without traditional credit histories to access loans.

“How do we use AI so that [micro, small, and medium enterprises] will still get the chance – the potential to succeed and to drive their economic success? We use AI with alternative data. So we use other types of data, such as socio-economic data, geographic, their internet features, for example, connection data,” Henrich said.

There are lots of different types of data that you can actually use; where you get information about the people that you would like to extend loans. And when you do that, you will be able to offer to a larger population, than what we're doing currently with the traditional methods. And I think this way of alternative credit scoring,” she added.

Additionally, she pointed out the significance of AI in fighting financial crimes, such as detecting fraud and money laundering. One noteworthy application was the use of graph neural networks to identify complex relationships within financial transactions.

Heinrich explained that this approach helped prioritise suspicious activities and better understand the flow of funds across accounts.

Enhancing customer experience was another area of focus, and Heinrich underscored the potential of AI in delivering hyper-personalised recommendations and more natural, frictionless interactions through conversational AI.

Heinrich forecasts that virtual agents, powered by generative AI, are likely to play a pivotal role in this evolution.

Heinrich urged banks to consider expanding their services beyond traditional banking, finding innovative ways to add value to customers' lives.

However, the critical role of data in AI applications highlights the importance of using the right data to achieve the desired results. The key strategies for accelerating AI adoption in banking are to maintain a human-centric approach, out-of-the-box thinking, experimentation, and quick adaptation.

“‘The one who can adapt, who is flexible, will win’. And this is so important. Now in our world where we are fast moving, and changing, we need to adapt. We shouldn’t run away from AI, but embrace it and harness its powers and strengths for what they are.” Heinrich said.

Advertise

Advertise