Indonesia mulls tightening fintech, P2P regulations

New regulations may include higher capital hurdles for P2P players.

Indonesia has signalled that it will tighten regulation of fintech companies, particularly those in peer-to-peer (P2P) lending, which should curb risks for the country’s financial system, reports Fitch Ratings.

Fitch expects that tighter regulation of P2P lenders will include higher capital hurdles, which should encourage the exit of marginal players and put the sector on a sounder footing to sustain growth.

A proposed strengthening of underwriting and risk-management rules would be positive for industry stability, Fitch said.

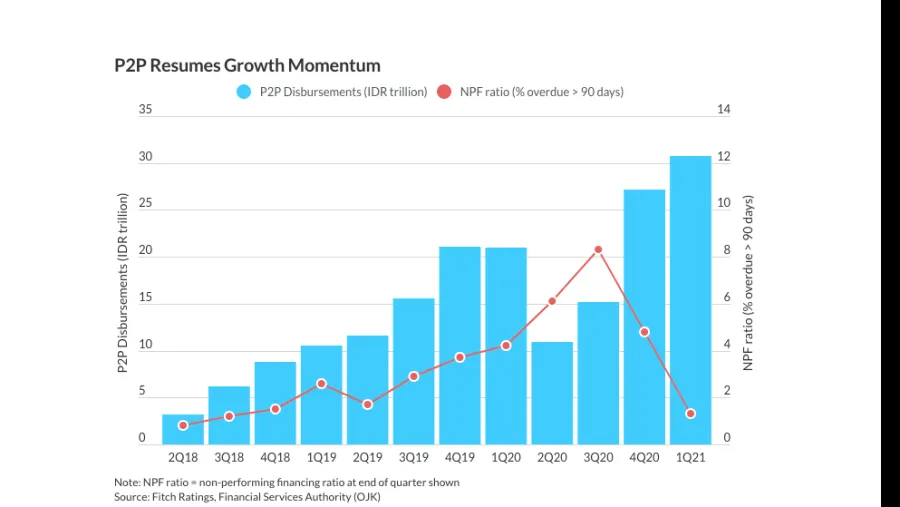

“The COVID-19 pandemic has boosted digital adoption in Indonesia, and increased use of services such as digital payments. However, it has also highlighted the presence of elevated credit risk across the sector as fintech lenders target under-banked segments of the population,” Fitch wrote in a media note, explaining that the proportion of delinquent loans rose sharply in Q2 - Q3 2020, although delinquencies have eased since Q4 2020.

Currently, the regulatory framework for P2P companies is simpler and includes modest minimum capital requirements, a prohibition against directly providing or receiving loans, and a mandatory ‘sandbox’ period for new entrants.

Loans on P2P platforms posted an 80% compound annual growth rate over 2018 to Q1 2021. Whilst fintech rivals and P2P lenders are unlikely to pose a major competitive challenge to Indonesia’s financial institutions—P2P lending make up less than 1% of the total system credit—they have the potential to shake-up the competitive landscape for financial services over time.

Notably, a number of Indonesia finance companies have entered the P2P segment to capitalise on its high growth. However, these ventures are small and unlikely to have near-term rating implications for these issuers, Fitch said.

Indonesian P2P's growth momentum

Advertise

Advertise