P2P lender Blend PH targets nearly $20m portfolio by 2021 in financial inclusion push

The platform has attracted millennials, housewives, and overseas workers that have been investing as low as $96 at 8-30% per annum.

Informal lending has been out and about in the Philippines. In the city, pawn shops offering monthly interest rates of 3-4% on average have been a refuge for people willing to pawn their phones, laptops, and other valuables for a few days in exchange for urgent money needed to pay the bills. The 5-6 lending scheme with an interest rate of 20% a month is also a go-to for small-time businesses around the city seeking quick liquidity fix.

The countryside has witnessed 139 closures of rural banks since 2009, leaving some municipalities totally unbanked and making informal lending the more convenient way to access loans. This comes in the form of people having to pawn their land titles or car registry as collateral in securing loans.

Only a fourth (22.6%) of adults in the Philippines are in possession of a bank account in 2017 which roughly translates to 15.8 million Filipinos out of the 103.3 million in total, central bank data show, as widespread poverty, heavy reliance on cash for day-to-day transactions and lack of documentary evidence contribute to low financial inclusion.

Against this setting, P2P players have found their place for both lenders and borrowers. Amongst them is Blend PH which just started their operations in 2018. With minimum investments for as low as $96 (PHP5,000) and interest rates ranging from 8-30%, Blend PH has lured lenders including millennials, housewives, overseas filipino workers (OFWs) and even institutional investors.

Borrowers eyeing for loans ranging from $28 (PHP2,000) to $38,355 (PHP2m) can choose to apply online for loans in Blend PH, without the need for collateral although the platform applies a fixed service charge of 6% for various investments . Its default rate is comparatively lower at 8% to default rates in the local P2P industry which could go to as high as 20%.

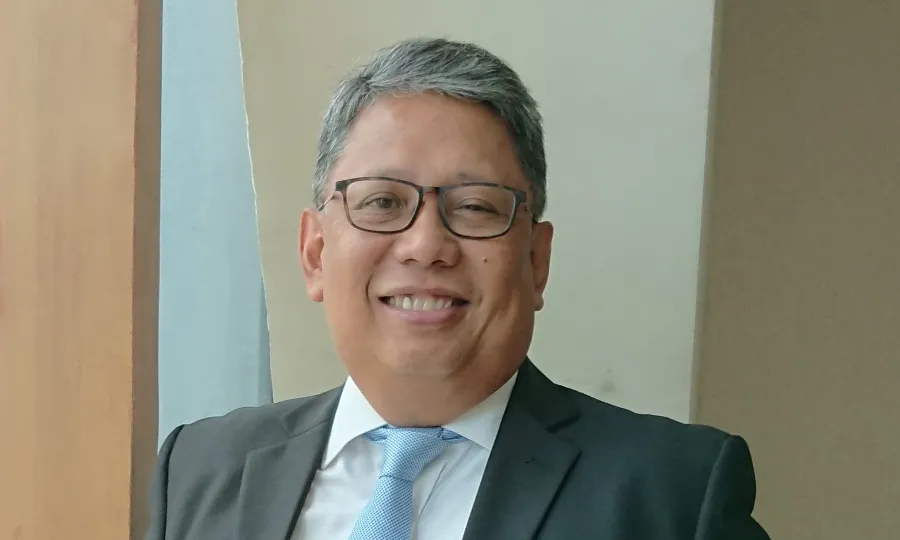

Asian Banking & Finance sat down with Jay Bautista, managing director of Blend PH to know more about the P2P player’s journey as they try to push for financial literacy through responsible borrowing and ethical lending in their platform.

Q: What was the initial response to Blend PH by lenders and borrowers?

Jay Bautista: We have millennial [lenders] and we also have housewives [lending their money] because you can do your investment from your home. And then of course, the high-net worth individuals, and Overseas Filipino Workers (OFWs) for that matter, those who have some financial literacy, knowledge on investment.

There are really a lot of borrowers, probably the ratio is 1 [lender] is to 3 [borrowers]. And for the lenders, there are small players, which pour in minimum investments. So as far as matching the portfolio between the loans applying for us against the funds available provided by the lenders, there's a huge gap. Our funding gap last year was about 75%.

Q: How do you deal with defaults?

Jay Bautista: We employ a strict underwriting process, which is actually patterned from the way banks do it. We really look into the value of both sides in the model - the borrower and the lender. It's more sensitive on the part of the lender, because it's their money being invested, and it's not ours.

That's why in the absence of a very good credit scoring or credit bureau in the Philippines, although there is one which is still in the works, we made a system that's 100% homegrown and developed. We have already considered coming up with our own algorithm that will allow us to at least initially assess a person based on his [financial] behaviour for us to somehow determine the character of the person as far as borrowers are concerned. After that, we painstakingly look at the background of the person by doing some call outs and verifications through other resources available.

Second, when we release the loans, we require the borrowers to submit post-dated cheques (PDCs) as payment for their amortisation because somehow coming up with a PDC will make the borrower criminally liable if they default.

Q: Are you open to having a regulatory body monitor P2P players in the Philippines?

Jay Bautista: We categorise ourselves as an IT company, as a fintech firm.I am open to being regulated by the Bangko Sentral ng Pilipinas (BSP) because we are handling financial transactions. We should be under the radar of BSP, but not on probably, you know, handling the money, but basically on how we do the transaction.

I'm open to being regulated because that also puts integrity in the way we do things and especially into our system. And I'd like to have that seal of approval from these regulators.

There’s already a law in place, the Data Privacy Act - that one is already being complied for in our system - handling the data, how we manage data and how we use data. But as far as the financial production is concerned, it is still a gray area.

Q: What is your outlook for P2P industry in the Philippines for the next five years? What is your outlook for Blend PH?

Jay Bautista: I'm very optimistic about it. To me, it does not end in providing a very good system or platform but incorporating an advocacy which I am starting which is responsible borrowing and moral and ethical lending.

If you look at our business model, we have formalised the informal lending process that is taking place in the Philippines which has been prevalent. They come in the likes of the 5-6 scheme by the Indian nationals, securing debts from friends and families, paluwagan, and borrowing from cooperatives. In some cases, people even just present titles of their land or car registry to secure loans in an informal way.

[There is a very high] unbanked population in the Philippines. In addition, the informal lending process and Filipino’s culture of getting used to just apologizing for late payments or unpaid debts, promoting the notion that the borrowing public is high risk. It's obvious that the corresponding isk is being mitigated by a higher interest rates. In return, the unbanked population continues because they're just used to the way they do things, and then at the same time, the lending side becomes so opportunistic.

I would like to put my focus on that side, because I would like to change that mindset amongst Filipinos, either on the borrowing or the lending side, that we are responsible borrowers.

I'm very optimistic. And in fact, we're looking at three years down the road that we will be able to build a $20m (PHP1b) portfolio in 2021.

Advertise

Advertise