4 factors intensifying the talent gap in the FinTech sector

A report revealed that demand for talent in the FinTech sector is still outpacing supply.

The talent gap in the FinTech sector is believed to intensify in the years to come as many companies (72%) expect faster growth for the industry.

According to the Singapore Fintech Talent Report 2022, demand for talent in the sector is still outpacing supply.

Intensifying the talent gap are four key factors: candidates expecting higher pay than offers (67%), companies finding difficulty in getting work permits for foreign workers (48%), candidates not being a right fit for to company culture (47%), and candidates preferring to work for competitors (46%).

To source talent, companies turn to employee referrals (90%), online job portals (81%), and headhunters and employment agencies (52%).

Companies are also increasingly tapping into partnerships with other companies as a channel for recruitment (33% in 2022 vs 20% in 2021).

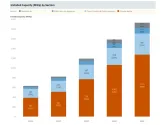

The report also revealed many employees are leaving FinTech companies in 2022. The number of companies seeing attrition rates of 10%-20% grew from 31% in 2021 to 42% in 2022.

Employees are reportedly leaving due to limited career development and enhancement as well as insufficient monetary and non-monetary rewards.

The report stated that companies have an insufficient investment in learning and development, with 50% spending less than $500 on such per employee.

Advertise

Advertise